Helping you grow your business

Helping you keep more of your income

We understand your needs

Adrian Mooy & Co - Accountants Derby

Welcome to Adrian Mooy & Co Ltd

Call us on 01332 202660

Receive our

Newsletter

... a digital firm using the best tech to help our clients

KASHFLOW

+

SNAP

IRIS

OPENSPACE

SAGE

New clients - easy three step process

MAKING

TAX

DIGITAL

XERO

+

DEXT

CHASER

FUTRLI

FLUIDLY

GO

CARDLESS

like yours grow and be more profitable.

a friendly service covering audit, tax, accounts, self assessment,

We offer a personal service and welcome new clients.

We are a firm of Chartered Certified Accountants

and tax advisors in Derby helping businesses

From start-up to exit & everything in-between.

Whether you’re struggling with company formation,

annual accounts and taxation, payroll or VAT you can

count on us at every step of your business’s journey. For

VAT & payroll please contact us.

Contact us

- Visit our office

- Request a callback

- Submit an enquiry

- Call us

- Email us

Building a relationship

- Initial consultation

- Understanding your

personal or business circumstances and requirements

Get a fixed fee

- Written Service Proposal

- Service breakdown

- Fixed fee quote

- Issue an Engagement

Letter

If you are looking for a Derby accountant please contact us.

○ Tax solutions to help you keep more of your income

○ Cloud-based accounting solutions

○ Transparent affordable pricing

We offer cloud-based accounting solutions. Using good technology saves time. With the power of cloud accounting in your hands, you can access accurate real-time data on the go, accept instant payments and even automate repetitive tasks like invoicing. Fast, easy, touch-of-a-button software can make a real difference to the way you run your business.

02/12/2015

Writer Name

Blog Post Title

Read more

Today's blog post

Services

We offer a range of high quality services

Self-employed sole traders

If you are starting your own business, running it as a sole trader is the quickest and easiest way to do it. However, you will have unlimited liability which means you are personally responsible for business debts.

Another important aspect is that you are taxed on all the profits with little opportunity for tax planning. This is why most businesses will incorporate as profits increase.

We can support you through business registration and provide advice on all aspects of tax including:

◦ Accounts for HMRC ◦ Self assessment ◦ VAT returns ◦

◦ Payroll services ◦ Tax planning ◦

Partnerships

Partnerships are similar to sole trades, except that they are used when more than one person owns the business.

Each profit share is determined by the partners and best practice is to record this in a partnership agreement.

With partnerships each partner has joint and several liability for the debts of the partnership, so that if one partner cannot pay their share of any business debts, the debt will fall on the other partners.

Setting up a partnership agreement from the outset is essential.

Limited companies

Corporate tax planning can result in significant improvements in your bottom line. Our services will help to minimise your corporate tax exposure.

Services include:

- Determining the most tax effective structure for your business

Self assessment

Self assessment tax returns are becoming increasingly complex and failing to submit your return on time, or correctly, can result in substantial penalties.

We use the latest tax software to ensure that tax returns are completed efficiently, accurately and on-time.

Self assessment: Taking

away the hassles of tax

We provide a comprehensive personal tax compliance service for individuals that includes:

- Completing your personal tax return

- Calculating your liability for the year and advising you of the due dates for payment

- Dealing with claims to reduce payments on account, which can be beneficial

- Dealing with HM Revenue & Customs investigations and aspect enquiries

Contractors & IR35

Invoicing your contracting work through a limited company is tax efficient. We will advise you on how to structure your contract to minimise IR35 risk. We will ensure you claim all the expenses that you are entitled to and work out if you can save money by joining the VAT Flat Rate Scheme. We will complete your accounts and tax returns and provide you with clarity over your tax payments.

Included in the service • IRIS KashFlow + Snap • Annual accounts • Corporate tax return • Personal tax return • Payroll • Dividend administration • VAT returns • Contract reviews • Dealing with HMRC

VAT, payroll, CIS & bookkeeping

VAT • is one of the most complex tax regimes imposed on business. We provide a cost effective service including assistance with registration & completing your returns.

Payroll • Administering your payroll can be time consuming. We provide a comprehensive payroll service.

Your Payroll Solution

Construction Industry Scheme • CIS returns & payments

Book-keeping • Maintenance of accounting records

Provision of management accounts

For more about these services please contact us.

Keeping the Books

Audit & assurance

Assurance

If your business does not require a statutory audit then our Assurance Service will provide reassurance that your accounts stand up to close scrutiny from your bank or other finance providers.

Work is tailored to your specific requirements and the level of confidence that you are looking to achieve and will provide credibility to your accounts by the issuing of an assurance review report.

Audit

We strive to provide an auditing service that adds more value than merely the statutory compliance requirement of an audit.

We tailor the audit to meet your circumstances and needs. Using the latest techniques and software we deliver a cost-effective audit that provides real value.

Business start-up advice

Before starting out you may need help with business planning, cash flow and profit & loss forecasts.

You may also want help identifying the best structure for your business. From sole trades and partnerships to limited companies and limited liability partnerships, we have the experience to advise on the best solution for you both operationally and from a tax point of view.

We also advise on accounting software selection, profit improvement, profit extraction & tax saving.

If you wish to know more about our Business Start-up service please contact us on 01332 202660.

Landlords & property

Accountancy and taxation of property is a specialist area. We have the expertise and experience to work effectively with private landlords and property investors. We deal with self-assessment tax, accounts preparation & tax advice for all aspects of property portfolios.

Whether you are a first time buy to let landlord or a long established developer we will discuss and understand your situation in order to advise and recommend the most appropriate medium through which to carry out your property investments. We will guide you through the accounting and tax issues and help you to plan effectively.

- Tax returns

- Property accounts

- Company accounts

- CGT and income tax planning

- VAT advice

Accounts services

Annual Accounts Preparation

We take the time to explain your accounts to you so that you understand what is going on in your business.

Management Accounts

Up to date, relevant and quickly produced management information for better control.

As part of our accounts service we prepare your annual accounts and complete yearly personal and business tax returns.

As your year-end approaches we will agree a timetable with you for completion of the accounts that minimises disruption to your business and leaves no late surprises when it comes to your tax liabilities.

We can also prepare management accounts to help you run your business and make effective business decisions. Management accounts are also very useful when approaching lending institutions when no year end accounts are available. We offer:

- Monthly or quarterly management accounts

- Budgeting and forecasting

- Management reports identifying key variances and recommendations

For a meeting to discuss your requirements please call us on 01332 202660.

Accounts

Tax services

Our objective is to ensure you pay the minimum tax required by law.

Corporation tax

We understand the issues facing owner-managed businesses.

Self Assessment

We provide advice on personal tax & planning opportunities.

Everyone who is subject to tax needs professional advice and support if they are to optimise their tax position and ensure they meet the compliance requirements.

Corporation tax services

Under Corporation Tax Self Assessment the legal responsibility for correctly calculating the corporation tax liability falls on business owners. We will help to minimise corporate tax exposure and relieve the administrative burden of compliance with current tax legislation.

Personal tax services (including sole-traders and partnerships)

We take the headache out of Self Assessment and provide you with practical advice on personal tax and the planning opportunities available to you. Over recent years HMRC have increased the penalties for failing to file a return on time and for errors. We complete tax returns, calculate any tax liability and advise you on exactly when to make payments.

Payroll

Running a small business places many demands on your time. We can help lift the load with our complete payroll service.

Designed to ease your administrative burden, our service removes what is often a time consuming task, leaving you free to concentrate on managing your business.

Meeting your obligations as an employer can be daunting especially with the introduction of Real Time Information (RTI).

Throughout the year, we will calculate your employees' net pay, report the relevant information to HMRC and provide you with payslips for your staff. Late payments or underpayments of employers' deductions can now lead to hefty penalties.

We can also prepare your benefits and expenses forms and advise you of any filing requirements and national insurance due. Benefits and expenses can be a complicated area and knowing what to report can be tricky.

We can file all your in-year and year end returns with HMRC and provide you with P60s to distribute to your employees at the year end.

We also offer a solution to meet your auto-enrolment obligations.

VAT

Guiding you through the complexities of VAT

Businesses dealing with the requirements of VAT legislation will agree that this is often a complex area.

Our VAT services cover all the basics, helping you to meet your obligations. Contact us to see how we can help you.

Determining whether you need to register for VAT, handling the administration of your returns and ensuring you are paying the correct amount of VAT can be both time consuming and complicated.

Our compliance services offer support for all stages of completing your VAT returns, whether you need advice on the treatment of specific transactions or have produced your records and would like verification that they are correct.

We can also advise on the pros and cons of voluntary registration, extracting maximum benefit from the rules on de-registration and the Flat rate VAT scheme.

Our consultancy service guides you through the intricacies of the legislation, pinpointing areas where you may be able to relieve or partly relieve the cost of VAT for your business, for example when purchasing new equipment or undertaking new projects such as property development.

For a meeting to discuss VAT and obtain further advice please call us on 01332 202660.

Tax planning

Corporate tax planning

We can conduct a full tax review of your business and determine the most efficient tax structure for you.

Personal tax planning

We give personal tax advice to a wide variety of individuals, including higher rate tax payers, company directors & sole traders.

We can help with tax planning to ensure that the tax impact of a strategy is considered.

Efficient tax planning can make a significant difference to the amount of tax that ultimately becomes payable. We constantly review developments in taxation and are always on hand to add our expertise to any planned course of action or transaction to achieve maximum tax efficiency.

We can assist with:

- Business structuring and profit extraction

- Capital Gains Tax planning

- Tax efficient restructuring

- Trust tax planning

- Wealth protection, including Inheritance Tax planning & Pensions planning

For a meeting to discuss your requirements please call us on 01332 202660.

Tax

Planning

Web-based accounting

Xero is a web-based accounting system designed with the needs of small business owners in mind.

It can automatically connect to your bank and download your bank statements. From there it’s simple to tell Xero what transactions relate to and once told it remembers and looks out for similar transactions. This saves time and makes keeping your accounts up to date easier.

Log in from any web browser. As your accountant we can log in and provide help.

Log in from any web browser. As your accountant we can log in and provide help.

Making Tax Digital - VAT

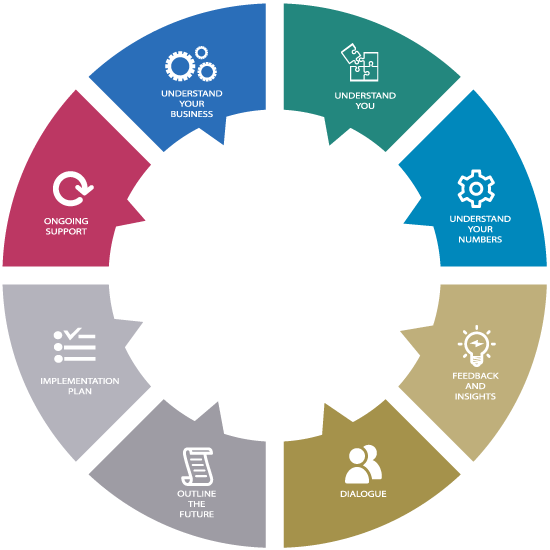

Our Process

Understand your needs

Firstly we listen and gain an understanding of your business and what you are aiming to achieve.

Continuous improvement

We seek your opinions on the service we provide and respond to feedback in order to upgrade and improve what we do.

Build a relationship

Success in business is based around relationships and trust. Our objective is to develop and build strong relationships with our clients, based on two way trust and respect.

Confirm your expectations

Our aim is to help you maximise your business potential and we tailor our service to meet your requirements and agree a timetable for delivering them.

Actively communicate

Communication is important to the success of any commercial venture. It is therefore a vital part of our work with you, sharing the knowledge and ideas that help you to realise your ambitions.

Our Process

Understand your needs

Confirm your expectations

Actively communicate

Build a relationship

Continuous improvement

Straightforward and easy to deal with Adrian Mooy & Co provide an efficient, friendly and professional service - payroll, tax returns, annual accounts and VAT returns are always done on time. Eddie Morris

Call us on 01332 202660

Testimonials

First class! Super accountant! We have been with Adrian Mooy & Co since 1994. They provide a prompt, accurate & reliable service. There is always someone at the end of the phone to help and advise us. They have always delivered and we are more than happy to recommend them. Ian Cannon

Helpsheets

Getting the tax right: Gifting a property Pt1

The tax implications associated with gifting a property. There are various situations when one person may wish to gift a property to another. This process brings tax implications depending on the circumstances, and whether the property is a main residence or a second property.

Capital gains tax

The basic premise is that should a property be gifted or sold for less than market value, capital gains tax (CGT) will be payable by the donor if the recipient is a ‘connected person’ (i.e., a family member, family trust). This rule does not apply if the sale is at ‘arm’s length’ between two unconnected parties. Gifts to a spouse or civil partner are generally deemed to have been transferred at a value that does not create a gain or a loss. Transfers of assets between spouses or civil partners under a formal divorce or separation agreement or court order are also generally made at no gain or loss.

If the property has been the owner’s main residence for at least part of the ownership period, principal private residence (PPR) relief can be claimed, extending to the last nine months (or 36 months, if the owner has entered long-term care).

Children are deemed ‘connected’, so there is a disposal for CGT purposes of any property not covered by PPR relief; the disposal proceeds being market value at the date of the gift. The problem here is that as no money changes hands, the donor may incur a ‘dry’ CGT bill as a result of giving the property to the connected person (i.e., as there will be no disposal proceeds from which to pay the bill, the donor will need to find the money from elsewhere).

Inheritance tax

At the time the gift between individuals is made, no inheritance tax (IHT) will be payable. The gift is classified as a potentially exempt transfer and remains free from IHT if the donor lives for at least seven years from the date of the gift.

If the donor survives for more than three years the gift will form part of the donor’s estate although taper relief will be available to reduce the IHT tax payable. IHT will be payable on the gift if not covered by the nil-rate band.

Reservation of benefit

A key challenge in IHT planning involving a main residence is that the donor often wishes to continue living there.

Under the ‘gifts with reservation of benefit’ (GWR) anti-avoidance rules, any gift to a connected person risks being caught by this rule, rendering the arrangement ineffective for IHT purposes and the property being treated as remaining part of the estate upon the donor’s death.

The gift of an undivided share of an interest in land is not a GWR if either of the following conditions is satisfied:

• The donor does not occupy the property, or occupies it to the exclusion (or virtual exclusion) of the donee for full consideration (e.g., full market rent).

• The donor and donee both occupy the property, and the donor receives no (or negligible) benefit from the donee in connection with the gift.

While the IHT legislation does not provide a definition for ‘virtual exclusion’, HMRC’s Inheritance Tax Manual (at IHTM14333 ‘Gift with Reservation’) offers examples reflecting HMRC’s interpretation. For example, the GWR provisions will not come into play if the donor stays in the property (in the absence of the donee) for less than two weeks each year, or stays with the donee for less than one month each year. Temporary visits (e.g., whilst the donor recovers from treatment following medical treatment) and short-term domestic visits are also allowed.

Pay market rent

To mitigate the GWR charge, one strategy is for the donor to pay full market rent to continue residing in the property.

However, this comes with a disadvantage, because unless there is consistent income, any capital used to pay the rent may be depleted. The rent should be reviewed periodically to reflect market changes.

Joint occupation

In this situation, the donee can remain in the property so long as either the donor continues to meet all expenses, or the donee pays no more than their share. The occupants will basically need to strictly split all bills fairly. ... continued ...

Getting the tax right: Gifting a property Pt2

Pre-owned asset charge

In an attempt to circumvent the GWR rules, a variety of complex schemes have been developed in the past, the most common being the ‘home loan’ or ‘double trust’ scheme. Over time, these schemes have been tested in the courts, leading to the introduction of the ‘pre-owned assets tax’ charge (POAT).

The POAT charge is a separate anti-avoidance measure that can apply even if the GWR rules do not. The POAT rules broadly state that if an asset is gifted or a contribution made towards the purchase of the property and the donor continues to receive some benefit, they are potentially liable to the POAT charge (e.g., money given to a child who buys a flat shortly afterwards and the parent lives in the flat).

This charge is distinct from IHT, functioning instead as an income tax charge based on the annual benefit assumed to be received by the donor from the property. To avoid the charge, a donor may elect for the property to come within the GWR rules instead, with the value of the occupation being measured by using annual rental values.

There exists a benefit threshold of up to £5,000 per annum that is disregarded; however, if the total benefit from the land (and any other items) exceeds this amount, income tax will be calculated on the entire value of the benefit (i.e., even the first £5,000 is not disregarded).

Variations of these loan schemes have been attempted by taxpayers, with HMRC challenging them before the tax tribunals. One such example (but where the taxpayer won) is the recent case Executors of Mrs LV Elborne v HMRC [2025] UKUT 59 TCC. Following this decision, HMRC is likely to expedite amendments to IHTA 1984 to counteract similar future schemes.

In 2003, Mrs Elborne sold her home to trustees of a life interest trust, in exchange for an unsecured, zero‑interest loan broadly equal in value to the home at the time when the home loan scheme was implemented. She retained a life tenancy, living rent‑free (but paying all expenses) until her death. The loan note was then gifted to the trustees of a second life interest ‘family’ trust from which Mrs Elborne was excluded from benefit, which satisfied the PET conditions by her surviving for seven years.

The executors agreed that the value of the property in the life interest trust was chargeable in the estate due to her qualifying life interest (this being a pre-2006 settlement) but claimed a reduction in value by the amount of the outstanding debt (the loan note). Furthermore, as the loan note had been gifted more than seven years before death, it could not be chargeable in her estate, unless there was a GWR. HMRC disagreed and disallowed the loan note deduction.

The Upper Tribunal ruled that no benefit had been reserved, stating that it was irrelevant to the holder of the loan note (i.e., the trustees of the family settlement) where Mrs Elborne lived.

Stamp duty land tax/ Land and Buildings Transaction Tax/ Land Transaction Tax

On making a gift, normally, no stamp duty land tax (SDLT), is due by the recipient if no money changes hands.

However, when a property is transferred with a mortgage and that mortgage is taken on by the recipient, SDLT is due on the value of the debt transferred.

The same rules exist under the Land and Buildings Transaction Tax (LBTT) in Scotland and Land Transaction Tax (LTT) in Wales.

Practical tip

In July 2025, the government published draft legislation proposing that from 6 April 2027, unused pension funds are generally included in a deceased’s estate for IHT purposes. Should the legislation be enacted in its current form, many estates that previously fell below the IHT threshold could now be caught, potentially triggering a 40% tax charge. Some financial advisers are considering equity release to mitigate this additional IHT exposure, particularly where property constitutes a significant portion of their clients’ estate. By unlocking tax-free cash, money could be gifted during the donor’s lifetime (noting the sevenyear PET rule), thereby reducing the value of their taxable estate for IHT purposes.

Beware of avoidance schemes using LLPs - Part 1

A tax avoidance scheme marketed at landlords and why it should be avoided.

HMRC has recently published a ‘Spotlight’ (Spotlight 69) drawing attention to a tax avoidance scheme targeted at landlords.

The scheme involves the transfer of the landlord’s property business to a limited liability partnership (LLP), which is subsequently liquidated, to avoid capital gains tax (CGT) on the eventual disposal to a limited company. However, in HMRC’s opinion, the scheme does not achieve its desired objective and anyone using the scheme will be liable for interest and penalties on the tax they sought to avoid, as well as the tax itself.

Legislation introduced in Finance Act 2025 ensures that a CGT charge now arises on a member who contributes assets to an LLP which is then liquidated in their favour or in favour of a connected person.

The scheme

A typical scheme works as follows.

1. A landlord has (usually for many years) run a property business (say, in London) as an unincorporated business.

2. The landlord incorporates their business as an LLP.

3. The landlord transfers their rental properties, which are often pregnant with substantial capital gains, to the LLP at market value.

4. After a short period, the LLP is put into a members’ voluntary liquidation (MVL).

5. If the business is continuing, the properties are then sold to a limited company owned by the landlord or a connected party.

6. For the purposes of the MVL, the LLP is considered to acquire its assets at the time of the contribution for their market value.

Landlords are told that this will result in them paying less tax because it enables them to transfer their properties into a company free of CGT without applying ‘incorporation relief’. There is no CGT when the property is transferred to the LLP, as there is no change in the underlying ownership. Likewise, there is no CGT on the disposal by the LLP to the company, which also benefits from a tax-free uplift in the base cost.

Further, there is no stamp duty land tax (SDLT) to pay on the transfer of the properties to the LLP or from the LLP to the limited company in the above scenario, because special rules apply in respect of interests to or from a partnership. It is also claimed that the scheme will deliver inheritance tax (IHT) benefits in the form of business property relief (BPR).

HMRC’s opinion

HMRC is of the view that the scheme does not work, and has published Spotlight 69 to warn landlords not to be taken in by claims made by the promoters. In HMRC’s opinion, the alleged CGT, SDLT and IHT savings will not be forthcoming.

At the time of the Autumn 2024 Budget, legislation was published in draft for consultation to counter the avoidance of CGT via the use of an LLP which is then liquidated. The legislation was included in Finance Act 2025 and is now contained in TCGA 1992, s 59AA. It applies in relation to liquidations that commence on or after 30 October 2024 (but not to those started before that date).

For tax purposes, a partnership is generally transparent for tax purposes and assets held by an LLP are treated as if held by the members. Consequently, no CGT liability arises when assets are transferred to the LLP, as the ownership of the asset does not change. However, TCGA 1992, s 59A also provides that this treatment ceases to apply on the appointment of a liquidator. It is on this provision that the efficacy of the scheme hinges.

The anti-avoidance rules introduced by Finance Act 2025 counter this by deeming there to be a disposal when an LLP is liquidated and assets that a member has contributed are disposed of to that member or to a person or company connected with them. In the scheme as outlined above, the disposal by the LLP to a company owned by the landlord or a connected person falls squarely within the scope of TCGA 1992, s 59AA.

This means that where the liquidation was commenced on or after 30 October 2024, the LLP will be liable for CGT in the normal way on the disposal of its assets, resulting in a CGT bill for the member on the disposal to the limited company.

As the disposal by the landlord is at market value, a chargeable gain will arise on the difference between the amount that the landlord paid for the property and its market value at the date of transfer to the LLP (less costs of acquisition and disposal and any improvement expenditure). However, the CGT savings perceived by the scheme may be forthcoming where the liquidation commenced prior to 30 October 2024.

Beware of avoidance schemes using LLPs - Part 2

Other implications

As far as SDLT is concerned, HMRC takes the view that because of the pre-arranged steps taken in using the scheme, the provisions contained in FA 2003, s 75A need to be considered. This, too, is an anti-avoidance provision which was introduced to counter schemes that sought to reduce or eliminate an SDLT charge that was contrary to the intention of the legislation.

The anti-avoidance legislation applies where there is a disposal which involves a number of transactions and the SDLT payable is less than would have been due on a direct disposal to the eventual owner. Consequently, HMRC’s view is that SDLT would be payable as if the property had been disposed by the member to the company. The SDLT relief that would otherwise apply on the transfer by a partnership to a limited company is lost.

In the Spotlight, HMRC also highlights the potential for the company to be subject to the annual tax on enveloped dwellings (ATED), which potentially applies where a company holds residential property valued at more than £500,000.

However, there are a number of ATED exemptions that can apply, including an exemption for qualifying property rental businesses. The relief is not given automatically and must be claimed. Penalties may be charged if a return or a relief declaration is not filed on time.

It is also unlikely that BPR for IHT purposes will be available, as a rental property business is likely to fall within an exclusion for the ‘making or holding of investments’.

HMRC is also considering whether the scheme may fall foul of the general anti-abuse rule (GAAR), which can be used to counter tax avoidance arrangements that, while within the letter of the law, fall outside the intentions of parliament. Where arrangements fall within the scope of the GAAR, HMRC can make a reasonable adjustment to the tax to counter the avoidance.

However, there are taxpayer safeguards in place and the scheme must be put before the independent GAAR advisory panel before a counteraction notice can be issued.

Landlords using the scheme

HMRC strongly advises landlords using the scheme described in the Spotlight or a similar scheme to withdraw from the scheme and settle their outstanding tax liabilities. Landlords affected can contact HMRC by email at spotlight69@hmrc.gov. uk. It is also advisable that they seek professional advice.

HMRC targets promoters of tax avoidance schemes. Promoters of tax avoidance schemes must comply with the disclosure of tax avoidance schemes (DOTAS) legislation. Failure to disclose a tax avoidance scheme will result in significant penalties being charged.

Landlords looking to incorporate

Recent tax changes have led many landlords to consider whether it would be worthwhile to run their business as a property company. However, landlords should be wary of convoluted routes to incorporation that seem to promise tax savings. When transferring properties to a limited company, there is a disposal at market value. However, unless disclaimed, incorporation relief will apply, which will defer the CGT bill until the disposal of the shares received in consideration. The company will also pay SDLT on the acquisition of the properties. There can be advantages to using an LLP. However, this should be considered in its own right, rather than as an indirect route to running the property business through a limited company.

Practical tip

Schemes that seem too good to be true often are, and landlords tempted by schemes that seem to offer significant tax savings should proceed with caution and take tax expert professional advice.

What’s happening to furnished holiday accommodation? Pt1

The tax regime for furnished holiday lettings will unwind over 2025.

The government of the time announced that it would abolish the furnished holiday letting (FHL) regime (sometimes referred to as the furnished holiday accommodation (FHA) regime), with effect from April 2025 (i.e., 1 April 2025 for companies, and 6 April 2025 for income tax – individuals, partnerships, trusts, etc.)

In truth, the government had been toying with abolishing the FHA regime entirely since as far back as 2009, when it was forced to accept that restricting the regime’s scope solely to UK properties was discriminatory under EU law. At the time, FA 2011 grudgingly widened the scope of FHA to include properties in the European Economic Area, but removed perhaps the most valuable tax income tax reliefs (flexibility for FHA losses). There appears to have been little substantive outcry since the 2024 announcement, so maybe the post-2011 regime was just not worth that effort. Even so, there are numerous consequences to the loss of FHA status, as now prescribed in FA 2025, s 25 and Sch 5.

This article focuses on the main changes and their implications.

Key changes

The main aims of the 2025 legislation are to withdraw the remaining favourable tax treatments surrounding FHA status, while smoothing a path towards ‘ordinary property business’ status, either as part of the landlord’s pre-existing property business, or simply to comprise that ordinary or mainstream property business now in its own right, from April 2025 (and note HMRC largely intends to treat that business as continuing, just without the tax breaks):

(NB. Companies with periods that straddle the 1 April 2025 transition will be treated for transition purposes as having two periods: one running up to 31 March 2025, and one running from 1 April 2025).

Key effects

(a) Mortgage interest relief – Going forward, landlords subject to income tax at higher rates will have to suffer the same restrictions on finance costs deducted against their former FHAs as for ordinary residential lettings (i.e., tax relief on finance costs limited to 20%). As many mainstream property business landlords will already know to their cost, the precise mechanism may well push formerlyFHA landlords into higher tax brackets, by initially disallowing finance costs in their entirety and then allowing a tax ‘credit’ (reduction) afterwards.

(b) Profits split between spouses or civil partners – Another benefit of having FHA status was that coowned FHA property in joint names between only spouses (or only civil partners) was not automatically split 50:50, but largely as those two spouses (or civil partners) decided. This quasi-partnership ‘protection’ (formerly at ITA 2007, s 836(3)) has now disappeared, so married couples, etc., will now need to be particularly mindful of their profit allocations for such joint property.

(c) Losses – Losses from the formerly-FHA business will be ‘converted’ to corresponding ordinary property letting business losses from April 2025. Previously, FHA losses were streamed separately from any ‘ordinary’ property letting losses, but they are now aggregated into one amount (but UK losses remain separate from overseas losses). Where the FHA business was formerly running at a loss but the landlord’s mainstream letting business was making profits, this will be beneficial. Likewise, broadly, where the landlord had previously been making losses in their mainstream property business, while their FHA lettings are profitable, they will now be able to absorb those losses, going forward.

(d) Fixed assets – Fresh capital expenditure on items in FHAs will no longer be potentially eligible for capital allowances. Any remaining ‘pool’ of expenditure already in the capital allowances regime by April 2025 will be treated as the pool (or part of the pre-existing pool) of the corresponding mainstream property business going forward, so eligible to be written down until that mainstream property itself ceases, or a small pool allowance is claimed for pools standing at £1,000 or less (CAA 2001, s 56A).

The fact that the assets that gave rise to that residual expenditure may now be in an ‘ordinary’ let dwelling does not trigger a balancing adjustment (but if a third party buys that property, they will not be able to access your capital allowances like they could previously). The fresh or future expenditure on replacing those fixed assets will, in many cases, potentially rank for replacement of domestic items relief, where freestanding, or even as simple ‘repairs’ to the overall fabric of the residential property, where fixed to the building (fixtures, etc.).

Reclaiming VAT on a car – notoriously difficult to claim

The VAT tax rules are clear - input tax cannot be claimed on the purchase of a new or used car that is made available for any private use. However, input tax can usually be claimed on cars used as a tool of a trade such as by a driving school, taxi firm or private car hire business, even if there is minor private use.

This strict rule was tested in a recent tax case of Maddison and Ben Firth T/A Church Farm v HMRC 2002. This case also underlines the importance of documents when submitting a claim to HMRC.

Mr and Mrs Firth were in business registered for VAT as 'subcontracting glam/camping, weddings and events' - mainly organising weddings and other events. The business claimed input tax on the purchase of two new cars, on the basis that they were used exclusively for business purposes and not available for private use. However, the Tribunal agreed with HMRC that there was insufficient evidence to prove a business-only intention. Importantly they came to this conclusion based on the insurance policy which included insurance for 'Social, Domestic and Pleasure' (SDP). Although Mr Firth explained that it was very difficult to obtain insurance without SDP the option was still available and that was enough to refuse the claim. The Tribunal stated that fact that the insurance policies did not cover the carrying of passengers on a commercial charge basis was an important point and refused the claim. Relevant factors quoted in the case were 'who has access to the car and when; what is the likelihood that the car will never be used for mixed business and private journeys; what is the availability of the car; whether the user keeps a log of journeys; whether the car is insured for private use; and whether the vehicle has any peculiar feature or adaptations for a particular kind of business use?'

In addition, although there was a valid council issued private operator licence, private hire was not covered by the policy. It also did not help Mr Firth's case that although an Audi TT has five seats it is, in effect, a two-seat car and as such not a practical car for private hire (one of the exceptions to the VAT rules).

Finally, HMRC refused a claim for the VAT input on a personalised number plate fixed to a motorcycle, finding that it was personalised to include Mr Firth’s first name. The claim was for business advertising but HMRC disagreed and refused the claim as the number plate (BS70 BEN) did not refer to the business named 'Church Farm'.

As ever in such cases, looking at the facts, this case should probably not have reached as far as a Tribunal Hearing. However, this case underlines the importance of 'intention' and of documents in supporting any claim for input VAT.

Employer’s National Insurance contributions and how they work

Three main changes to Employer’s National Insurance contributions (NICs) were announced in last October’s Autumn Statement, all of which came into effect from 6 April 2025:

• The rate of Employer’s NICs increased from 13.8% to 15%.

• The threshold at which Employer’s NICs start to be due reduced from £9,100 to £5,000 per employee.

• The employment allowance (EA) went up from £5,000 to £10,500, with a removal of the £100,000 test which previously prohibited larger employers from claiming it.

Winners and losers

The interaction of these changes will result in winners and losers, particularly in relation to the EA, which was significantly increased. The EA is an allowance for businesses (which meet certain criteria) to reduce their Employer’s NICs liability.

When she delivered the Autumn Statement 2024, Rachel Reeves said: “This will allow a small business to employ the equivalent of four full-time workers on the national living wage without paying any National Insurance on their wages.”

Let’s break that down. The national living wage (NLW) is the minimum hourly rate which must be paid to employees and workers over 21. Lower amounts apply to those under 21 or those in their first year of an apprenticeship. It’s worth noting that company directors, although treated as employees for tax purposes, are not required to be paid the NLW unless they have a separate employment relationship with the company.

For 2025/26, the NLW is £12.21 per hour, so for a full-time employee working 35 hours per week, that comes to £427.35 per week, or £22,222 per year. Employer’s NICs is calculated as 15% above the £5,000 threshold, so the tax due would be (£22,222 - £5,000) x 15% = £2,583.30. With four employees, the total NICs comes to £10,333.20 which would be covered by the £10,500 EA - meaning no employers’ NIC is due on their wages.

Of course, this is a simplification and does not take into account factors like overtime, benefits-inkind or paying annual or performance bonuses. It also assumes a 35-hour working week rather than, for example, a 37.5-hour or 40-hour week, which some people work. But it makes good rhetoric at the despatch box.

Do the sums

Interestingly, the £5,000 threshold creates an incentive to employ more people for fewer hours. For example, if the business employed part-time workers for 20 hours per week, their pay at the NLW rate would be 20 x £12.21 = £244.20 per week or £12,698 per year, resulting in NICs of £1,155 per employee. They could employ nine part-time employees and still have the NICs covered by the £10,500 allowance. Employing part-time workers gives them 9 x 20 = 180 working hours per week rather than 4 x 35 = 140 hours per week with fulltime employees.

A similar principle applies for employees. If I have one job earning £36,000 a year, I would pay NICs of £1,874.40, but if I have three jobs each paying £12,000, I pay no NICs (unless certain ‘aggregation’ rules apply) because each job pays below the £12,570 primary Class 1 NICs threshold.

Points to note

A couple of things to bear in mind relating to the EA:

• The EA has to be claimed each year via payroll software.

• It is available to most employers (including self-employed, partnerships, LLPs, companies, etc.).

• Single-director companies with no other employees cannot claim. You must have at least one other employee paid above the £5,000 threshold to qualify.

• You cannot claim for personal, household, or domestic staff.

• The allowance may have to be split between ‘connected companies’ depending on the circumstances. Practical tip

With the EA now worth £10,500 per year, make sure you are claiming it if you are eligible. You can also claim for previous years if you’ve missed an eligible claim in the past

Useful Links

Jointly owned properties and MTD

Unincorporated landlords who had combined property and trading income in 2024/25 of £50,000 or more must comply with Making Tax Digital for Income Tax Self-Assessment (MTD for ITSA) from 6 April 2026. This requires them to keep digital records and make quarterly returns and a final declaration to HMRC using MTD-compatible software.

Where landlords jointly own a property, there are some points to note.

Working out qualifying income

A landlord is only within MTD from 6 April 2026 if their combined property and trading income (before the deduction of expenses) is £50,000 or more in 2024/25

Where a landlord receives income from a jointly owned property, they only need take account of their share of the income from that property in working out their qualifying income. For example, if two brothers jointly owned a house in respect of which rental income of £20,000 was received in 2025/26 which was shared equally, each brother will need to take into account income of £10,000 in working out their qualifying income.

Digital records

Under MTD for ITSA a landlord must keep digital records of their income and expenses. Where a landlord receives income from a jointly owned property, they only need to keep digital records for their share of the income and expenses.

Landlords with income from jointly owned property can choose to simplify their record-keeping by creating less detailed digital records for the jointly let properties. This means creating a single digital record for each category of property income received in an update period and creating a single digital record for each category of property expenses incurred in a tax year. For example, where the landlord receives rent of £1,000, they can either create a digital record for each monthly rent payment or a single digital record of £3,000 for the rent received in the quarterly update period.

Reporting easement

MTD for ITSA requires landlords within its scope to make quarterly returns on property income and expenses using MTD-compatible software.

However, to simplify matters, where a landlord receives income from a jointly owned property, an easement applies under which the landlord can opt not to include expenses that relate to a jointly let property in their quarterly update. Instead, this information is finalised at the end of the tax year.

Making tax digital: Where are we now? - Part 1

Latest developments in making tax digital.

We are now little more than a year away from the phased introduction of making tax digital (MTD) for income tax self assessment (MTD ITSA), as follows:

Annual aggregate turnover (all sources) Implementation date

More than £50,000 5 April 2026

More than £30,000 and up to £50,000 5 April 2027

More than £20,000 and up to £30,000 Before this Parliament ends (2029)

This last new, lowest band was announced as part of the Autumn Statement 2024 on 30 October 2024:

‘The government will expand the rollout of MTD to those with incomes over £20,000 by the end of this Parliament, and will set out the precise timing for this at a future fiscal event.’

Up to that point, many advisers were daring to hope that MTD might perhaps baulk at going lower than the initial £50,000 per annum threshold.

Key points It is perhaps worth emphasising:

• The thresholds are measured across one’s annual gross income across all business sources (i.e., rents are broadly lumped in alongside all trading receipts – but see also below).

• The measurement year for testing whether one is caught for April 2026 (being the start date for those individuals in the vanguard) will be 2024/25, the actual numbers for which may only just have been finalised and filed by 31 January 2026.

• Thus, do the results for 2024/25 (now) dictate the MTD status for 2026/27?

• Likewise, the measurement year for whether MTD for ITSA will apply for the lower £30,000 annual threshold from April 2027 (i.e., 2027/28) will be the actual results for 2025/26.

• But each separate trade and property business* will still need its own set of quarterly returns ‘updates’.

• Once a taxpayer is caught by MTD ITSA, that annual aggregated business turnover will need to fall below the threshold for three successive years in order to break free of its clutches.

*Generally, all property sources are rolled into a single property business; however, one might have separate UK and offshore rental businesses or lettings in different ‘capacities’, such as sole or joint tenancies, as against a full property partnership.

Given that the annual threshold is intended to have fallen to just £20,000 by 2029, one will presumably have to hope for another means of escape, such as business cessation (see also below).

Income boxes and joint property details

HMRC will monitor taxpayers’ incomes and corresponding MTD obligations by reference to specific boxes on their submitted tax returns – the gross trading income and rental receipts sections. This should be reasonably straightforward, but a quirk has arisen in relation to joint lettings.

Landlords holding only a proportion of joint property are, of course, reliant on whoever prepares that property’s accounts for their income and expenditure details. They are also allowed to choose to include only the net income figure from joint lettings in their current-format tax returns (whether as part of a larger portfolio or not).

In July/August 2024, HMRC confirmed that this easement would continue under MTD, despite the risk of the landlord understating their ‘true’ gross annual income by potentially including only the net amounts for co-owned property letting income.

Making tax digital: Where are we now? - Part 2

Audit trail abandoned When the quarterly ‘update’ regime was originally devised, it was intended that each return would report only that quarter’s results, and that any amendments to previous quarters in the tax year would have to be reported in the next available return but flagged separately so that HMRC could track any changes made.

HMRC has since walked back from this approach and announced in November 2023 that each quarterly return will now hold simply ‘year-so-far’ amounts without further analysis into separate quarters, etc.

Quarterly update deadlines On 22 February 2024, the latest regulations then published included that the quarterly updates’ filing deadlines would be extended by two days, to 7 August/November/February/May, thereby aligning with the usual VAT stagger group filing deadline for calendar quarters.

End of the ‘end of period statement’ Did anyone realise that, when the Chancellor announced ‘the end of the annual tax return’ back in July 2015, what he actually planned instead was a ‘final declaration’, plus four quarterly returns (‘updates’) for each separate business of theirs, plus an annual end of period statement for each business to cover all of the usual annual tax adjustments for disallowed expenses, capital allowances, etc?

But never mind because, ever keen to cut down on taxpayers’ administrative burdens, the government has magnanimously decided to remove the proposed end of period statement and just include all those tax adjustments in the final declaration, instead.

Presumably, the government is banking on nobody spotting that the updated final declaration will now function almost exactly like the tax return whose demise was promised almost a decade ago, just now with a load of extra form-filling obligations that nobody outside of HMRC ever asked for.

Exemptions and exclusions The list of specific exemptions from MTD ITSA has grown slightly:

• Trustees;

• Personal representatives of someone who has died;

• Lloyd’s members;

• Individuals without a National Insurance number (announced Autumn Statement 2023); and

• Foster carers (announced Autumn Statement 2023).

However, just because someone is a Lloyd’s name or foster carer does not mean that they are entirely exempt from MTD; if they have ordinary non-exempt sources, they can be ‘caught’ for those. Likewise, the National Insurance Number exemption will, for most people, last only until they receive their notification – usually just before their 16th birthday.

A wider exemption may be accepted where the taxpayer can show that they are unable to comply with the requirements of MTD, such as by reason of:

• old age or infirmity;

• remoteness of location (poor Internet access); or

• religion.

It seems that, so far, HMRC has resisted the temptation to hide the ‘digital exclusion’ application process behind an online application form.

Conclusion The greatest menace in MTD is not the digital filing and reporting, but the digital record-keeping; having to set up and maintain financial records in a manner tailored more to HMRC’s wants than your own business needs. This is the other, as-yet-unseen nine-tenths of the MTD iceberg.

But in promising to drop the entry threshold to as low as £20,000 per annum, the government has signalled to taxpayers (and to software companies) how firmly it has committed us to this project. For now, there are no precise dates on when MTD for ITSA will be extended to partnerships or to companies (‘avoiding’ MTD might soon be one of the few remaining tax-based incentives to incorporate) but, again, keep in mind that partners will not automatically be safe from MTD if they also have non-partnership business interests.

Keeping digital records for Making Tax Digital

Making Tax Digital for Income Tax Self-Assessment (MTD for ITSA) will apply from 6 April 2026 to sole traders and unincorporated landlords with combined trading and property income in 2024/25 of at least £50,000.

Under MTD for ITSA, traders and landlords must keep digital records and make digital returns to HMRC using MTD-compatible software.

A digital record is a record of income and expenses that is created and stored in software that works with MTD for ITSA. Under MTD for ITSA, a trader must keep digital records of their trading income and expenses, and an unincorporated landlord must keep digital records of their property income and expenses. If a trader or landlord has other income, there is no need for them to keep records of that income digitally.

Software

Traders and landlords within MTD for ITSA will need to use software that either creates digital records and submits information to HMRC or software which connects to the trader or landlord’s own record-keeping software, such as a spreadsheet. This type of software is known as bridging software.

Taxpayers can choose a single product that meets all their needs or a number of products that work together. Where more than one product is used, they must link digitally. For example, it is acceptable to keep records in a spreadsheet which is linked digitally to software to submit information to HMRC. However, it is not acceptable to manually enter or cut and paste data from a spreadsheet into a software package.

Records that must be kept digitally

The following records must be kept digitally:

- self-employment income, such as sales, takings and fees;

- self-employment expenses, such as the cost of goods, travel costs, office costs, rent, etc.;

- property income, such as rent, lease premiums, reverse premiums and inducements; and

- property expenses, such as repairs, maintenance, travel, etc.

The amount, the date the income was received or payment made and the nature of the income or expense should be recorded. The income and expenditure categories for MTD for ITSA are the same as for the Self-Assessment tax return.

If a trader has more than one business, they will need to keep the details for each business separately and make separate quarterly returns for each business. Landlords should keep separate records for their UK and foreign property businesses.

Jointly let properties

Where a landlord has income from a jointly let property, they only need to keep digital records relating to their share of the income and expenses. Landlords with income from jointly let properties can opt to keep less detailed records or to exclude income from jointly let properties in their quarterly updates; the income is instead included when the position for the tax year is finalised.

Turnover below the VAT threshold

If a trader’s turnover from a single self-employment is £90,000 or less, they only need to record whether a transaction is income or an expense. More detail is not required.

Landlords with income from residential letting need to record whether a transaction is an income or an expense and, where it is an expense, whether it is a restricted finance cost.

Once income reaches £90,000, transactions must be fully categorised.

Retailers

Retailers can create a digital record of gross daily takings rather than having to record each individual sale.

Storing digital records

Digital records must be kept for at least five years from the 31 January submission date for the tax year in question, i.e. for 2026/27, until 31 January 2033.

New 40% FYA and reduction in WDAs

A new 40% first-year allowance (FYA) is to be introduced from April 2026. It will apply to main rate expenditure on new assets, excluding cars. Both companies and unincorporated business will be able to benefit. The new allowance will be available from 1 January2026 for corporation tax and from 6 January 2026 for income tax.

From 1 April 2026 for corporation tax and 6 April 2026 for income tax the main rate of writing down allowance (WDA) is reduced from 18% to 14%. A hybrid rate will apply where the chargeable period spans the date of the rate change.

Utilising the new allowance

Companies have a range of options for relieving main rate expenditure in the year in which it is incurred. The annual investment allowance (AIA) provides immediate relief for qualifying expenditure on new and used assets and applies to both qualifying main rate and special rate expenditure. However, it is subject to an annual limit of £1 million.

Companies can also take advantage of full expensing to deduct qualifying expenditure on new main rate assets. Full expensing is available without limit.

Like full expensing, the new 40% FYA applies to qualifying expenditure on new main rate assets. As full expensing can be used without limit, the 40% FYA will only be of use to a company where the expenditure is outside full expensing. This will be the case, for example, for assets used for leasing.

The new 40% FYA is also available to unincorporated businesses.

The cash basis is the default basis of accounts preparation for traders. It allows capital expenditure to be deducted when computing profits unless the expenditure is of a type for which such a deduction is specifically prohibited. Cars fall into this category. Where a deduction is not allowed, capital allowances can be claimed (unless simplified expenses have been used to claim relief for mileage costs).

Capital allowances are of more relevance where the trader uses the accruals basis. Unincorporated businesses can access the AIA, but do not benefit from full expensing. The new 40% FYA will be useful to them where the AIA has been used up, and also where expenditure qualifies for the new 40% FYA but not the AIA.

Where the 40% FYA is claimed, the balance of the expenditure is relieved by main rate WDAs.

Reduction in the WDA

The rate of WDA on main rate expenditure drops from 18% to 14% from 1 or 6 April 2026. This will lengthen the period over which relief is given for expenditure on main rate assets. It will have an impact where the business opted not to claim the AIA or full expensing on qualifying main rate expenditure or, from January2026, where the new 40% FYA is claimed.

Cars, other than new zero emission cars, are not eligible for any of the FYAs. Low emission cars are allocated to the main pool. The reduction in the main rate WDA will mean that it will take businesses longer to fully relieve the cost of main rate cars than is currently the case.

Where the chargeable period spans the date on which the rate changes, a hybrid rate will apply. This will reflect the number of days in the chargeable period before the rate change and the number of days on or after the rate change. For example, where a company prepares accounts to 30 June, the hybrid rate for the period to 30 June 2026 is 17%.

Looking ahead to MTD for landlords

The way that many landlords will report details of their income and expenses to HMRC is changing from April 2026 onwards. This is when Making Tax Digital for Income Tax Self Assessment (MTD for ITSA) comes into effect. Landlords who fall within the scope of MTD for ITSA will need to keep digital records, use MTD-compatible software and send quarterly updates to HMRC. This will impose new compliance obligations on them and change the way in which they interact with HMRC.

Start date 1: 6 April 2026

MTD for ITSA will apply to unincorporated landlords and sole traders with trading and/or property income of £50,000 or more from 6 April 2026. When determining a landlord’s MTD start date, it is important to take account of both rental income from unincorporated property businesses and also trading income from unincorporated businesses (such as those operated as a sole trader). However, any rental income from property companies can be ignored. The key figure is the total of both rental and trading income, so a landlord with rental income of £10,000 and trading income of £45,000 will be within MTD for ITSA from 6 April 2026 while a landlord with rental income of £49,000 who has no trading income will have a later start date. The relevant income will be that for 2024/25, as reported on the Self Assessment tax return which must be filed by 31 January 2026.

It is important that landlords with an April 2026 start date make sure that they know how MTD for ITSA will affect them, and that they are ready to comply from 6 April 2026 onwards.

Once within MTD for ITSA a landlord remains within it, even if their income falls to below the trigger threshold, unless it remains below the trigger threshold for three successive tax years.

Start date 2: 6 April 2027

Landlords running unincorporated property businesses will be brought within MTD for ITSA from 6 April 2027 if they have rental income and/or trading income from an unincorporated business of £30,000 or more.

Other landlords

The Government plan to bring unincorporated landlords and unincorporated businesses with rental and/or trading income of £20,000 or more into MTD for ITSA by the end of the current Parliament. As of yet, no date has been set for those whose income is below this level.

Obligations

Currently, where rental income is more than £1,000 (and the landlord is not within the rent-a-room scheme), they must report their taxable profits to HMRC on the property pages of their Self Assessment tax return by 31 January following the end of the tax year to which it relates. They must keep records of their income and expenses, but can do so in a way that suits them.

Under MTD for ITSA this all changes. The landlord will need to keep digital records and use software that is compatible with MTD for ITSA to report simple summaries of income and expenses to HMRC on a quarterly basis. The quarters run to 5 July, 5 October, 5 January and 5 April, although taxpayers can report to calendar quarters instead (30 June, 30 September, 31 December and 31 March). HMRC publish details of commercial software that fits the bill. They have also said that they will make free software available for those with the most straightforward affairs.

After the final quarterly update for the year has been submitted, the landlord will need to make a final declaration to finalise their income tax position for the tax year. This is like the current tax return and it is at this stage that the taxpayer will claim reliefs and allowances, and also reflect other income that they may have which is not within the MTD process, such as savings and investment income and income from employment. The landlord will also need to make a declaration that the information is complete and correct, as is currently the case on the Self Assessment tax return.

There is no change to the way in which tax is paid under MTD for ITSA, only the way in which income is reported.

Keeping digital records for MTD

One of the key requirements under Making Tax Digital for Income Tax Self-Assessment (MTD for ITSA) is the need to keep digital records of income and expenses. A digital record is a record of income or an expense that is created and stored using software that is compatible with MTD for ITSA.

There are different software options available. A landlord within MTD for ITSA can either choose a single software package that does everything or different software products that work together. For example, a landlord could record income and expenses in a spreadsheet that is linked by software (bridging software) to another package for submitting returns to HMRC. It is important to note that where more than one product is used, they are linked digitally. It is not permissible to enter figures manually or to cut and paste from one program to another.

Information that must be recorded

A landlord within MTD for ITSA will need to keep records of property income, such as rent, premiums for the grant of a lease, reverse premiums and inducements, and property expenses, such as repairs, maintenance and cleaning, digitally.

The landlord will need to record the following in their digital records:

- the amount;

- the date on which it was received or incurred; and

- the category into which it falls.

The income and expenditure categories used for MTD for ITSA are the same as for the Self-Assessment tax return.

Different property businesses

If a landlord has both a UK property business and an overseas property business, they will need to keep separate digital records for each business.

Jointly let properties

A landlord with income from jointly let properties only need include their share of the income and the expenses. There is an easement which allows landlords with income from jointly owned properties to keep less detailed digital records.

Turnover of under £90,000

If the landlord’s total property turnover is less than £90,000, they can choose to categorise their digital records in less detail. If a landlord has income from residential lettings, they can record only whether a transaction is an income or an expense, and for expenses, whether the expense is a restricted finance cost.

Property income allowance

Landlords claiming the property income allowance do not need to record this in their digital records. Instead, it is claimed at the end of the tax year when the position for the year is finalised.

Incorporation: Points to consider

Some important tax issues when considering incorporation.

The question as to whether a business should operate through a limited company is often dictated by the tax implications, though not always – insulation of the individual from commercial risks is often reason enough.

The term ‘incorporation’ can also include transferring a business (usually a partnership) into a limited liability partnership (LLP) as they, like limited companies, are bodies corporate with a separate legal identity.

However, LLPs are treated exactly the same as ordinary partnerships for tax purposes, i.e., they are transparent with the partners (or ‘members’ as LLP partners are known) taxed on their profit or capital shares. When a partnership becomes an LLP, it is essentially a non-event for tax purposes, even though a new legal entity is operating the trade; however, becoming a limited company is very much an event for tax purposes.

Capital gains tax

The main issue is that when a sole trader, or partnership, transfers business assets into a limited company, it is treated as a disposal for capital gains tax (CGT) purposes on the owner, even though they own the recipient company and the business is one of a going concern.

The default position, assuming all assets have gone across to the company, is that the notional capital gain will be rolled over into the value of the shares, which the owner will receive in consideration. However, this default relief – ‘incorporation relief’ (under TCGA 1992, s 162) – can be disapplied and the CGT paid instead.

Incorporation relief is quite an unusual relief. First, it is automatic (unless disapplied); second, it applies to ‘businesses’ and not just trades as required by the other CGT reliefs. This is useful for those businesses which might resemble more of an investment than trade, such as a rental property portfolio; whilst renting land will never be a trade, it might be a business if it is operating as such when sufficient hours and activity are provided by the owner.

The main criterion for TCGA 1992, s 162 relief is that all assets (except cash) go into the company; if that is not the case, section 162 relief is not available and CGT will be chargeable. However, one reason why business owners might disapply the relief is because they do not want a latent gain with the shares; they may prefer to ‘have it over with’, pay the tax at the current rate and, more importantly, claim business asset disposal relief if they can.

If TCGA 1992, s 162 is not activated and the disposal remains chargeable, the consideration received by the business owner will be mainly in the form of a directors’ loan account; this can then be drawn down, tax-free, whenever the company has the funds to make repayments. It is therefore important to value the business assets properly, as an overvalued sale may lead to a greater loan account, with corresponding ‘excess’ drawdowns being taxable as dividends.

Stamp duty land tax, etc.

The tax which may be of most concern is stamp duty land tax (SDLT) in England and Northern Ireland (or its devolved equivalents); under FA 2003, s 53, the transfer of land or buildings to a connected company attracts a deemed charge based on market value consideration; SDLT must be paid within 14 days of completion, so it is a major strain on cashflow.

Incorporating a family partnership, all of whose partners are related or are the same people as the subsequent shareholders, can potentially avoid the charge via provisions in FA 2003, Sch 15; however, there are anti-avoidance provisions within FA 2003, Sch 15, para 17A acting as an effective exit charge within the first three years; also, the antiavoidance rule in FA 2003, s 75A is a much wider provision striking down any arrangement made to avoid SDLT. A legitimate business partnership looking to incorporate for genuine commercial reasons should have nothing to fear, but SDLT is a complicated area, and an expensive one if you get it wrong.

Practical tip

When considering incorporation, factor in the CGT or SDLT cost of doing so, as well as the company and individual’s tax position going forward. If faced with a high upfront cost for those taxes, the potential long-term savings of incorporation may still make it a worthwhile cost.

Mileage allowance payments

To save work, employers can pay employees a mileage allowance if they use their own car for business journeys. The Government have recently cleared up confusion as to what can be paid tax-free, confirming the maximum tax-free amount.

Mileage allowance payments - The approved mileage allowance payments system is a simplified system that allows employers to pay tax-free mileage allowance payments to employees who use their cars for business travel. Under the system, payments can be made tax-free up to the ‘approved amount’.

A similar, but not identical, system applies for National Insurance purposes.

The approved amount - The approved amount for tax is calculated for the tax year as a whole and is simply the reimbursed business mileage for the tax year multiplied by the tax-free mileage rates for the type of vehicle used by the employee. Rates are set for cars and vans, motor cycles and cycles and are as shown in the table below. They have been unchanged since 2011/12.

Example - Mo uses his own car for business and drives 12,350 miles in the tax year. The approved amount is £5,087.50 (10,000 miles @ 45p per mile + 2,350 miles @ 25p per mile).

Any payments made in excess of the approved amount are taxable and must be reported to HMRC on the employee’s P11D. If, on the other hand, the employer does not pay a mileage allowance or pays less than the approved amount, the employee can claim a deduction for the difference between the approved amount and the amount actually paid, if any.

Confusion - Earlier in the year, a petition went before Parliament calling for an increase in the advisory rate from 45 pence per mile to 60 pence per mile to reflect the increases in fuel prices since 2011. Parliament rejected the petition stating that the rates remained adequate as they covered all running costs and the fuel element was only a small part. However, in their response, they pointed out that employers could pay higher amounts tax-free where this represented the amount of actual expenditure and could be substantiated:

‘The AMAP rate is advisory. Organisations can choose to reimburse more than the advisory rate, without the recipient being liable for a tax charge, provided that evidence of expenditure is provided.’

The Government subsequently backtracked on this, stating in a written Parliamentary statement that:

‘The response [to the petition] stated that actual expenditure in relation to business mileage could be reimbursed free of Income Tax and National Insurance contributions. This is in fact only possible for volunteer drivers. Where an employer reimburses more than the AMAP rate, Income Tax and National Insurance are due on the difference. The AMAP rate exists to reduce the administrative burden on employers.’

Maximum tax-free amount - The maximum amount that can therefore be paid tax-free to employees using their own car for work is the approved amount, regardless of the car that they drive or the actual costs incurred. However, if the employer wishes to pay more, car sharing could be encouraged and the employer could also pay passenger payments (of 5 pence per mile) for each colleague that the driver gives a lift to (providing the journey is also a business journey for them).

For company car drivers, the maximum tax-free amount that can be paid is governed by the prevailing advisory fuel rates published by HMRC.

Contact

Whether it is answering questions, making an appointment, or pointing you in the right direction, we look forward to hearing from you.

We just need a few details and we'll be in touch shortly.

Adrian Mooy & Co is the trading name of Adrian Mooy & Co Ltd. Registered in England No. 05770414.

Registered office: 61 Friar Gate, Derby, Derbyshire, DE1 1DJ T: 01332 202660

Adrian Mooy & Co Ltd - 61 Friar Gate Derby DE1 1DJ - adrian@adrianmooy.com