Helping you grow your business

Helping you keep more of your income

We understand your needs

Adrian Mooy & Co - Accountants Derby

Welcome to Adrian Mooy & Co Ltd

Call us on 01332 202660

Receive our

Newsletter

... a digital firm using the best tech to help our clients

KASHFLOW

+

SNAP

IRIS

OPENSPACE

SAGE

New clients - easy three step process

MAKING

TAX

DIGITAL

XERO

+

DEXT

CHASER

FUTRLI

FLUIDLY

GO

CARDLESS

like yours grow and be more profitable.

a friendly service covering audit, tax, accounts, self assessment,

We offer a personal service and welcome new clients.

We are a firm of Chartered Certified Accountants

and tax advisors in Derby helping businesses

From start-up to exit & everything in-between.

Whether you’re struggling with company formation,

annual accounts and taxation, payroll or VAT you can

count on us at every step of your business’s journey. For

VAT & payroll please contact us.

Contact us

- Visit our office

- Request a callback

- Submit an enquiry

- Call us

- Email us

Building a relationship

- Initial consultation

- Understanding your

personal or business circumstances and requirements

Get a fixed fee

- Written Service Proposal

- Service breakdown

- Fixed fee quote

- Issue an Engagement

Letter

If you are looking for a Derby accountant please contact us.

○ Tax solutions to help you keep more of your income

○ Cloud-based accounting solutions

○ Transparent affordable pricing

We offer cloud-based accounting solutions. Using good technology saves time. With the power of cloud accounting in your hands, you can access accurate real-time data on the go, accept instant payments and even automate repetitive tasks like invoicing. Fast, easy, touch-of-a-button software can make a real difference to the way you run your business.

02/12/2015

Writer Name

Blog Post Title

Read more

Today's blog post

Services

We offer a range of high quality services

Self-employed sole traders

If you are starting your own business, running it as a sole trader is the quickest and easiest way to do it. However, you will have unlimited liability which means you are personally responsible for business debts.

Another important aspect is that you are taxed on all the profits with little opportunity for tax planning. This is why most businesses will incorporate as profits increase.

We can support you through business registration and provide advice on all aspects of tax including:

◦ Accounts for HMRC ◦ Self assessment ◦ VAT returns ◦

◦ Payroll services ◦ Tax planning ◦

Partnerships

Partnerships are similar to sole trades, except that they are used when more than one person owns the business.

Each profit share is determined by the partners and best practice is to record this in a partnership agreement.

With partnerships each partner has joint and several liability for the debts of the partnership, so that if one partner cannot pay their share of any business debts, the debt will fall on the other partners.

Setting up a partnership agreement from the outset is essential.

Limited companies

Corporate tax planning can result in significant improvements in your bottom line. Our services will help to minimise your corporate tax exposure.

Services include:

- Determining the most tax effective structure for your business

Self assessment

Self assessment tax returns are becoming increasingly complex and failing to submit your return on time, or correctly, can result in substantial penalties.

We use the latest tax software to ensure that tax returns are completed efficiently, accurately and on-time.

Self assessment: Taking

away the hassles of tax

We provide a comprehensive personal tax compliance service for individuals that includes:

- Completing your personal tax return

- Calculating your liability for the year and advising you of the due dates for payment

- Dealing with claims to reduce payments on account, which can be beneficial

- Dealing with HM Revenue & Customs investigations and aspect enquiries

Contractors & IR35

Invoicing your contracting work through a limited company is tax efficient. We will advise you on how to structure your contract to minimise IR35 risk. We will ensure you claim all the expenses that you are entitled to and work out if you can save money by joining the VAT Flat Rate Scheme. We will complete your accounts and tax returns and provide you with clarity over your tax payments.

Included in the service • IRIS KashFlow + Snap • Annual accounts • Corporate tax return • Personal tax return • Payroll • Dividend administration • VAT returns • Contract reviews • Dealing with HMRC

VAT, payroll, CIS & bookkeeping

VAT • is one of the most complex tax regimes imposed on business. We provide a cost effective service including assistance with registration & completing your returns.

Payroll • Administering your payroll can be time consuming. We provide a comprehensive payroll service.

Your Payroll Solution

Construction Industry Scheme • CIS returns & payments

Book-keeping • Maintenance of accounting records

Provision of management accounts

For more about these services please contact us.

Keeping the Books

Audit & assurance

Assurance

If your business does not require a statutory audit then our Assurance Service will provide reassurance that your accounts stand up to close scrutiny from your bank or other finance providers.

Work is tailored to your specific requirements and the level of confidence that you are looking to achieve and will provide credibility to your accounts by the issuing of an assurance review report.

Audit

We strive to provide an auditing service that adds more value than merely the statutory compliance requirement of an audit.

We tailor the audit to meet your circumstances and needs. Using the latest techniques and software we deliver a cost-effective audit that provides real value.

Business start-up advice

Before starting out you may need help with business planning, cash flow and profit & loss forecasts.

You may also want help identifying the best structure for your business. From sole trades and partnerships to limited companies and limited liability partnerships, we have the experience to advise on the best solution for you both operationally and from a tax point of view.

We also advise on accounting software selection, profit improvement, profit extraction & tax saving.

If you wish to know more about our Business Start-up service please contact us on 01332 202660.

Landlords & property

Accountancy and taxation of property is a specialist area. We have the expertise and experience to work effectively with private landlords and property investors. We deal with self-assessment tax, accounts preparation & tax advice for all aspects of property portfolios.

Whether you are a first time buy to let landlord or a long established developer we will discuss and understand your situation in order to advise and recommend the most appropriate medium through which to carry out your property investments. We will guide you through the accounting and tax issues and help you to plan effectively.

- Tax returns

- Property accounts

- Company accounts

- CGT and income tax planning

- VAT advice

Accounts services

Annual Accounts Preparation

We take the time to explain your accounts to you so that you understand what is going on in your business.

Management Accounts

Up to date, relevant and quickly produced management information for better control.

As part of our accounts service we prepare your annual accounts and complete yearly personal and business tax returns.

As your year-end approaches we will agree a timetable with you for completion of the accounts that minimises disruption to your business and leaves no late surprises when it comes to your tax liabilities.

We can also prepare management accounts to help you run your business and make effective business decisions. Management accounts are also very useful when approaching lending institutions when no year end accounts are available. We offer:

- Monthly or quarterly management accounts

- Budgeting and forecasting

- Management reports identifying key variances and recommendations

For a meeting to discuss your requirements please call us on 01332 202660.

Accounts

Tax services

Our objective is to ensure you pay the minimum tax required by law.

Corporation tax

We understand the issues facing owner-managed businesses.

Self Assessment

We provide advice on personal tax & planning opportunities.

Everyone who is subject to tax needs professional advice and support if they are to optimise their tax position and ensure they meet the compliance requirements.

Corporation tax services

Under Corporation Tax Self Assessment the legal responsibility for correctly calculating the corporation tax liability falls on business owners. We will help to minimise corporate tax exposure and relieve the administrative burden of compliance with current tax legislation.

Personal tax services (including sole-traders and partnerships)

We take the headache out of Self Assessment and provide you with practical advice on personal tax and the planning opportunities available to you. Over recent years HMRC have increased the penalties for failing to file a return on time and for errors. We complete tax returns, calculate any tax liability and advise you on exactly when to make payments.

Payroll

Running a small business places many demands on your time. We can help lift the load with our complete payroll service.

Designed to ease your administrative burden, our service removes what is often a time consuming task, leaving you free to concentrate on managing your business.

Meeting your obligations as an employer can be daunting especially with the introduction of Real Time Information (RTI).

Throughout the year, we will calculate your employees' net pay, report the relevant information to HMRC and provide you with payslips for your staff. Late payments or underpayments of employers' deductions can now lead to hefty penalties.

We can also prepare your benefits and expenses forms and advise you of any filing requirements and national insurance due. Benefits and expenses can be a complicated area and knowing what to report can be tricky.

We can file all your in-year and year end returns with HMRC and provide you with P60s to distribute to your employees at the year end.

We also offer a solution to meet your auto-enrolment obligations.

VAT

Guiding you through the complexities of VAT

Businesses dealing with the requirements of VAT legislation will agree that this is often a complex area.

Our VAT services cover all the basics, helping you to meet your obligations. Contact us to see how we can help you.

Determining whether you need to register for VAT, handling the administration of your returns and ensuring you are paying the correct amount of VAT can be both time consuming and complicated.

Our compliance services offer support for all stages of completing your VAT returns, whether you need advice on the treatment of specific transactions or have produced your records and would like verification that they are correct.

We can also advise on the pros and cons of voluntary registration, extracting maximum benefit from the rules on de-registration and the Flat rate VAT scheme.

Our consultancy service guides you through the intricacies of the legislation, pinpointing areas where you may be able to relieve or partly relieve the cost of VAT for your business, for example when purchasing new equipment or undertaking new projects such as property development.

For a meeting to discuss VAT and obtain further advice please call us on 01332 202660.

Tax planning

Corporate tax planning

We can conduct a full tax review of your business and determine the most efficient tax structure for you.

Personal tax planning

We give personal tax advice to a wide variety of individuals, including higher rate tax payers, company directors & sole traders.

We can help with tax planning to ensure that the tax impact of a strategy is considered.

Efficient tax planning can make a significant difference to the amount of tax that ultimately becomes payable. We constantly review developments in taxation and are always on hand to add our expertise to any planned course of action or transaction to achieve maximum tax efficiency.

We can assist with:

- Business structuring and profit extraction

- Capital Gains Tax planning

- Tax efficient restructuring

- Trust tax planning

- Wealth protection, including Inheritance Tax planning & Pensions planning

For a meeting to discuss your requirements please call us on 01332 202660.

Tax

Planning

Web-based accounting

Xero is a web-based accounting system designed with the needs of small business owners in mind.

It can automatically connect to your bank and download your bank statements. From there it’s simple to tell Xero what transactions relate to and once told it remembers and looks out for similar transactions. This saves time and makes keeping your accounts up to date easier.

Log in from any web browser. As your accountant we can log in and provide help.

Log in from any web browser. As your accountant we can log in and provide help.

Making Tax Digital - VAT

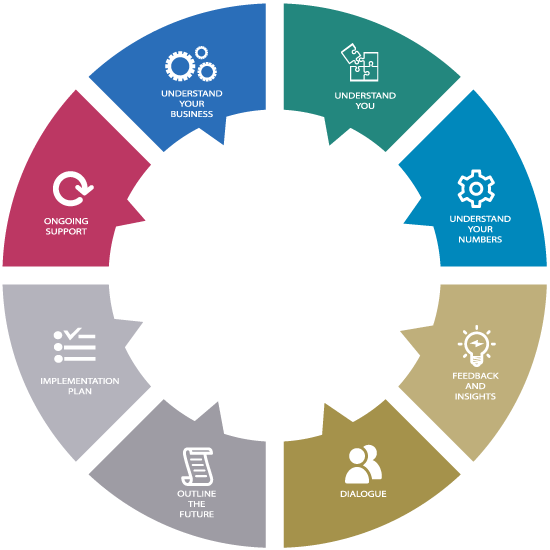

Our Process

Understand your needs

Firstly we listen and gain an understanding of your business and what you are aiming to achieve.

Continuous improvement

We seek your opinions on the service we provide and respond to feedback in order to upgrade and improve what we do.

Build a relationship

Success in business is based around relationships and trust. Our objective is to develop and build strong relationships with our clients, based on two way trust and respect.

Confirm your expectations

Our aim is to help you maximise your business potential and we tailor our service to meet your requirements and agree a timetable for delivering them.

Actively communicate

Communication is important to the success of any commercial venture. It is therefore a vital part of our work with you, sharing the knowledge and ideas that help you to realise your ambitions.

Our Process

Understand your needs

Confirm your expectations

Actively communicate

Build a relationship

Continuous improvement

Straightforward and easy to deal with Adrian Mooy & Co provide an efficient, friendly and professional service - payroll, tax returns, annual accounts and VAT returns are always done on time. Eddie Morris

Call us on 01332 202660

Testimonials

First class! Super accountant! We have been with Adrian Mooy & Co since 1994. They provide a prompt, accurate & reliable service. There is always someone at the end of the phone to help and advise us. They have always delivered and we are more than happy to recommend them. Ian Cannon

Helpsheets

2025 Autumn Budget - Significant points & Personal tax

Significant points

Personal tax allowances and rates on general income frozen for a further three years to April 2031

Also frozen: NICs employer threshold and upper earnings limit, and IHT nil band, to April 2031; Plan 2 Student Loan repayment threshold to April 2030

No immediate changes to reliefs on pension schemes, but salary sacrifices above £2,000 to be subject to National Insurance from April 2029

Increases in income tax rates on dividend income from April 2026, and on rental and savings income from April 2027

Only minor changes to Inheritance Tax rules announced last year

ISA investment limits and rules remain the same, but from April 2027 new £12,000 limit for cash within the £20,000

Corporation tax rates unchanged, but Writing Down Allowances reduced from April 2026; new FYA from 1 January 2026

Council tax surcharge on properties worth over £2 million to apply from April 2028

Personal Income Tax

Tax rates and allowances – 2026/27

In 2023, the previous Chancellor announced that the main personal allowance and the 40% threshold will remain at their 2022/23 levels until the end of 2027/28. In a major tax raising measure, Chancellor Reeves has extended this freeze to the end of 2030/31, in spite of stating explicitly in last year’s Budget that the normal increases in the thresholds would resume in April 2028.

This has been widely criticised as a ‘stealth tax’, in that it increases the amount collected without explicitly increasing rates or reducing allowances. For example, a person with a salary of £50,270 will pay £7,540 in income tax in 2025/26; if their income increases by 10% to £55,297 in any of the years to 2030/31, all of the increase will be taxed at 40%, and they will pay £9,551. The forecasts accompanying the Budget show expected revenue of over £12 billion from this in 2030/31, the largest tax-raising measure in the table.

The income level above which the personal allowance is tapered away also remains £100,000; it will be reduced to zero when income is £125,140, which is also the threshold for paying 45% tax. In the tapering band, the loss of tax-free allowance creates an effective marginal rate of 60%. Once again, annual increases in income will bring more people into these higher rates.

Dividend income - The dividend allowance exempts some dividend income from tax, although that income still counts towards the higher rate thresholds. For 2026/27, the allowance is unchanged at £500. As HMRC does not routinely receive information about dividends received by taxpayers, this low limit is likely to require people to file tax returns to declare even small tax liabilities on dividends.

In 2026/27, the basic and higher rates on dividend income over £500 will rise by 2% to 10.75% and 35.75%; the additional rate will remain 39.35%.

The higher rate also applies to tax payable by close companies (broadly, those under the control of five or fewer shareholders) on ‘loans to participators’ that are not repaid to the company within 9 months of the end of the accounting period. This therefore also increases to 35.75% from 6 April 2026.

Dividends arising in an ISA or a qualifying VCT are not taxed and do not count towards the allowance.

Savings income and property income - The savings allowance remains £1,000 for basic rate taxpayers, £500 for 40% taxpayers and nil for 45% taxpayers. People with savings income above these limits may have to declare it in order to pay tax.

The savings rate band remains at £5,000. Non-savings income is treated as the ‘first slice’ of income, using the tax-free allowance and the savings rate band; if any of the £5,000 band is not used by this ‘slice’, any savings income falling within that band is taxed at 0%.

The Chancellor announced an increase in the tax rates applicable to income from property and savings to apply from April 2027. The basic, higher and additional rates on rental and savings income will all rise by 2% in 2027/28 to 22%, 42% and 47%.

From April 2027, there will be new rules about the order in which certain tax reliefs are deducted from income, so that they must be set first against income which is taxable at the lower rates before they can be set against savings, rental and dividend income.

The Budget document points out that 90% of people do not pay tax on savings income; however, for those whose income from these sources exceed their tax-free allowances, it will be necessary to calculate and settle the liability each year.

These tax increases make tax-free Individual Savings Accounts even more attractive, as any income or gains arising within an ISA are tax-free.

Winter fuel payment - Earlier this year, the government relented and restored the Winter Fuel Payment to pensioners. However, it will be clawed back through the tax system from anyone with income of over £35,000. This can be avoided by disclaiming the payment in advance. The threshold of £35,000 will remain fixed for the duration of this Parliament.

2025 Autumn Budget - Employees

Company cars

The basis for taxing company cars and fuel provided for private use is set out in the Table. Annual increases in the rates for use of the car have already been set up to 2029/30 ‘to provide long-term certainty for taxpayers and industry’. The rates are intended to provide a strong incentive to use electric vehicles, while rates for hybrids will be increased to align more closely with the rates for internal combustion engine vehicles.

The figures used to calculate the following benefits all increase for 2026/27 by 3.8% in line with inflation:

l the benefit of free use of business fuel for private journeys;

l the taxable amount for the availability of a van for more than incidental private use;

l the taxable amount for an employee’s private use of fuel in a company van.

Expenses and benefits

From 6 April 2026, employees will no longer be able to claim a tax deduction for expenses of working from home, if these are not reimbursed by their employer. Employers will still be able to reimburse such costs where they are eligible without deducting income tax or NICs.

Also from 6 April 2026, the income tax and NICs exemption for employer-provided benefits will be extended to cover reimbursements for eye tests, home working equipment, and flu vaccinations.

Enterprise Management Incentive (EMI) Scheme

Under this scheme, employees and directors can be granted options over shares in the company for which they work. No Income Tax or NICs arise if options are exercised within ten years of being granted. Other conditions apply.

For eligible companies, the following maximum limits will apply to EMI contracts granted on or after 6 April 2026:

l the total value of company options that can be unexercised at any time will be increased from £3 million to £6 million;

l gross assets will be increased from £30 million to £120 million;

l the number of employees will be increased from 250 to 500 employees.

The maximum value of unexercised options an individual employee can hold remains £250,000.

The limit on the exercise period will be increased from 10 years to 15 years. Existing contracts can be amended without losing the tax advantages the schemes offer.

Image rights payments

From 2027/28, all image rights payments related to an employment will be treated as taxable employment income and subject to income tax, employer NICs and employee NICs. This will affect sports people who set up image rights companies to accumulate payments for the rights and follows a recent case involving the former England football captain Bryan Robson, which HMRC lost.

2025 Autumn Budget - NIC's, Savings and Pensions

Thresholds and rates

There has been a great deal of debate about the effect on employment and business of the increases in employer NICs that took effect on 6 April 2025 following the Chancellor’s first Budget in October 2024. In the present Budget, no changes were announced – the £5,000 threshold for secondary contributions will remain fixed until April 2031 (in the 2024 Budget, the Chancellor said this figure would rise with inflation after April 2028). The Upper Earnings Limit for employee contributions is linked to the 40% income tax threshold, and is therefore also fixed to the same date.

The Lower Earnings Limit and Small Profits Threshold will be increased for 2026/27 in line with inflation at 3.8%.

Class 2 NICs

It has been possible to ‘buy in’ to the State pension by paying voluntary Class 2 NICs in certain circumstances. The Budget included measures to restrict the availability of this route to a State pension for people resident outside the UK with effect from 6 April 2026. There will be a wider review of voluntary NICs in the new year

Savings and Pensions

Individual Savings Accounts (ISA)

The investment limits for ISA have not changed since 2017/18: they are £20,000 for a standard adult ISA (within which £4,000 may be in a Lifetime ISA), and £9,000 for a Junior ISA or Child Trust Fund. These will now remain fixed until 5 April 2031.

From 6 April 2027, no more than £12,000 of the £20,000 will be eligible for investment in a cash ISA, apart from ISAs for those aged 65 and over. The Chancellor presented this as an encouragement to invest in stocks and shares, which have performed substantially better than cash deposits over the years since ISAs were introduced.

Pension contributions

Among the rumours circulating in advance of the Budget was the possibility of restrictions on tax-free pension lump sums or the amounts that can be invested with tax relief. In the event, the Chancellor made no immediate changes to the reliefs available.

The maximum amount that can be withdrawn as a tax-free lump sum remains £268,275 unless the person is entitled to ‘protection’ in relation to the original introduction of the Lifetime Allowance or any of the subsequent reductions of the limit.

The only change relating to pension funds was another measure that was widely predicted: a restriction on ‘salary sacrifice’ arrangements. From April 2029, full tax relief on such an arrangement will be restricted to a contribution of £2,000. On amounts in excess of that, employer and employee NICs will be due as if cash salary has been paid (although the contribution will still be free of income tax).

Venture capital schemes

Generous tax reliefs are available for those who invest in Enterprise Investment Scheme (EIS) companies or Venture Capital Trusts (VCTs), which are quoted investment trusts that invest in EIS-type companies. These schemes have a lot of detailed conditions attached to them, some of which are being changed to make the schemes available to larger companies.

The gross assets requirement that a company must not exceed for the EIS and VCT will increase to £30 million (from £15 million) immediately before the issue of the shares or securities, and to £35 million (from £16 million) immediately after the issue.

The annual investment limit that caps how much companies can raise will increase to £10 million (from £5 million) and, for knowledge-intensive companies, to £20 million (from £10 million).

The company’s lifetime investment limit will increase to £24 million (from £12 million) and, for knowledge-intensive companies, to £40 million (from £20 million).

These increases apply only to qualifying companies that are not registered in Northern Ireland trading in goods or the generation, transmission, distribution, supply, wholesale trade or cross-border exchange of electricity. These companies will remain eligible only for the current scheme limits.

The Income Tax relief that can be claimed by an individual investing in a VCT will reduce to 20% from the current rate of 30%.

These changes take effect from 6 April 2026.

2025 Autumn Budget - Business Tax

Business rates

From 1 April 2026, business rates bills in England ‘will be updated to reflect changes in property values since the last revaluation in 2023’. The small business multiplier is being reduced to 43.2p and the standard multiplier to 48p.

The government will also introduce permanently lower multipliers for retail, hospitality and leisure (RHL) properties with rateable values under £500,000, set 5p below the national rates, making the small business RHL multiplier 38.2p and the standard RHL multiplier 43p. This will benefit over 750,000 RHL properties.

A new high-value multiplier will apply to properties above £500,000, such as the big warehouses of online retailers. This higher rate is being set at 2.8p above the national standard multiplier, making the high-value multiplier 50.8p in 2026/27.

Umbrella companies

An umbrella company employs workers on behalf of agencies and the businesses that the workers do the work for (the end client). From 6 April 2026, recruitment agencies and end clients will be jointly and severally liable for any payroll taxes on payments

to workers supplied through umbrella companies, where a non-compliant umbrella company fails to remit them to HMRC on their behalf.

If the labour supply chain has:

- more than one agency, the rules apply to the agency that has the direct contract with the end client to supply the worker;

- no agency, the rules apply to the end client.

Corporation Tax

Rate of tax

The rates of corporation tax have not changed, and last year’s Budget appeared to rule out changes for the life of the Parliament.

Late filing

From 1 April 2026, the penalties for late filing of corporation tax returns will be doubled. They will become £200 for any lateness (£1,000 for the third successive offence); a further £200 (or £1,000) if the return is still not filed after 3 months; and tax-geared penalties of 10% of the amount unpaid if they are still not filed after 6 and again after 12 months.

Capital allowances for plant and machinery

The 2025 Budget introduces several changes to capital allowances that will affect the timing of tax relief for businesses over the next two years.

The 100% First Year Allowance for new zero-emission cars and chargepoints has been extended until 31 March 2027 (5 April 2027 for unincorporated businesses), giving an additional year for businesses to secure full upfront relief on electric vehicles before these assets revert to slower relief through writing-down allowances.

A new 40% First Year Allowance will apply to qualifying main-rate plant and machinery from 1 January 2026, where full expensing or the £1 million Annual Investment Allowance are not available. This relief will be available to all businesses, including unincorporated businesses and those acquiring assets for leasing in the UK. Cars and second-hand assets are excluded.

From April 2026, the main rate writing-down allowance will reduce from 18% to 14%, slowing tax relief where upfront allowances cannot be claimed. The special rate writing-down allowance remains unchanged at 6%.

Full expensing continues unchanged for companies and remains the most beneficial route where available. Businesses with material or recurring capital expenditure should review investment plans ahead of the April 2026 changes to optimise relief.

R&D

The government will pilot a targeted advance assurance service from spring 2026, enabling small and medium-sized enterprises to gain clarity on key aspects of their R&D tax relief claims before submitting them to HMRC.

2025 Autumn Budget - CGT & IHT

Capital Gains Tax

Rates and annual exempt amount

In her first Budget, the Chancellor increased the rates of CGT and reduced a number of reliefs. The current Budget document included the forecast that the annual yield from the tax will more than double from £13.7 billion at the start of this Parliament to £30 billion in 2030/31.

The CGT annual exempt amount remains £3,000 for individuals and estates and £1,500 for most trusts. Individuals will continue to pay 18% on gains that fall within their basic rate income tax band, and 24% on gains above that.

Disposals to Employee Ownership Trusts

A CGT relief has exempted gains on eligible disposals of shares to Employee Ownership Trusts. The government will reduce the CGT relief available from 100%

of the gain to 50%. This will take immediate effect from 26 November 2025. Business Asset Disposal Relief (see below) will not be available on the remaining chargeable 50%.

Incorporation relief

When a sole trader or partnership transfers a business to a company in exchange for shares, any capital gains arising on the disposal of chargeable assets may be deferred by ‘incorporation relief’. Under the existing legislation, this operates automatically where the conditions are satisfied. From 6 April 2026, it will be necessary to make a claim for the relief to apply.

Business Asset Disposal Relief (BADR) and carried interest

As announced last year, the tax rate on gains that qualify for BADR will rise in 2026/27 from 14% to 18%. The relief remains available on qualifying gains with a lifetime limit of £1 million.

Investors’ Relief can give a reduced CGT rate to qualifying investors in qualifying companies for which they do not work. The lifetime limit is also £1 million and the rate of tax will rise in line with BADR.

In 2025/26, the rate of CGT on carried interest was a flat rate of 32% for individuals, estates and trusts. From 2026/27, carried interest will be brought within income tax and subject to its own specific rules.

Cryptoassets

Gains realised on cryptoassets such as Bitcoin are likely to be chargeable to CGT. In order to make sure that chargeable gains are being reported, the government will require UK-based Cryptoasset Service Providers to report on their UK tax resident customers under the Cryptoasset Reporting Framework. Information for first reports to HMRC will be collected from 1 January 2026 and reported to HMRC in 2027.

Inheritance Tax (IHT)

Rates - The IHT nil rate band has been fixed at £325,000 since 6 April 2009. The Chancellor has extended the freeze on this figure until the end of 2030/31. Holding the threshold at the same amount for 22 years will bring far more people into the scope of the tax. The Budget document states that IHT raised £8.3 billion a year at the start of this Parliament; this is expected to rise to £14.5 billion in 2030/31.

The £175,000 ‘residential nil rate band enhancement’ on death transfers (also frozen, together with the £2 million value of estate above which it is tapered) can reduce the impact where it applies. A married couple may be able to leave up to £1 million free of IHT to their direct descendants (£325,000 plus £175,000 from each parent), but the rules are complicated, and the prospect of the nil rate band being fixed for another

5 years increases the importance of proper IHT planning.

Agricultural and business property

The government has confirmed that the well-publicised restrictions on 100% agricultural and business reliefs will come in, as previously announced, from 6 April 2026. 100% relief will be restricted to £1 million of the total of qualifying agricultural and business property, with 50% relief on any higher value.

It was newly announced that the £1 million 100% allowance will be transferable between spouses, if it is not used on the first death, and this figure also will be frozen until April 2031.

Also from 6 April 2026, qualifying shares quoted on the AIM and similar ‘unlisted’ markets will qualify for 50% relief rather than the current 100% relief.

These changes could potentially create significant IHT liabilities for family farming and trading businesses in the future, including where business assets are held in trust. All businesses should consider their IHT position, including reviewing wills and considering whether some lifetime gifts of qualifying property may be worthwhile.

Unused pension funds and death benefits

The government has confirmed that, from 6 April 2027, most unused pension funds and death benefits will come within the deceased’s estate for IHT purposes, whether written into trust or not.

2025 Autumn Budget - VAT & Property Tax

Value Added Tax

Registration threshold

The VAT registration and deregistration thresholds last increased to £90,000 and £88,000 with effect from 1 April 2024. The March 2024 Budget stated that they will be again frozen at these new levels, but it did not say for how long. No changes or dates have been announced.

Private hire vehicles

The VAT treatment of private hire vehicles has been thrown into doubt by several court decisions involving Uber and other operators. The Tour Operators Margin Scheme (TOMS) has been held to allow firms to account for VAT only on the difference between the fare and the amount paid to the driver. While the past tax treatment is still the subject of ongoing litigation, the government will put the position beyond doubt going forward: from 2 January 2026, taxi and private vehicle hire services will not be eligible for the TOMS, except where they are provided as part of a package with certain other travel services. This means that a firm will have to account for VAT on the whole of a customer’s fare, where the firm has a contract with the customer as principal responsible for providing the ride.

Gifts to charity

A new VAT relief will be introduced from 1 April 2026 for business donations of goods to charity which are for distribution to those in need or for use in the delivery of their charitable services. Currently a business making such a gift could be liable for output tax on a deemed disposal of the goods.

E-invoicing

From April 2029, it will be a requirement to issue all VAT invoices in a specified electronic format. The government will work on a ‘roadmap’ towards implementation of this measure and will publish this next year.

Low value imports: customs duty

The government intends to remove the customs duty relief on goods imported into the UK valued at £135 or less, making them subject to customs duty from March 2029 at the latest, and is consulting on implementing a new set of customs arrangements for these goods.

Motability

The Motability scheme enables eligible people to buy vehicles that are adapted to enable them to use them, and provides some VAT reliefs. The Budget will impose, with effect from July 2026, 20% VAT on top-up payments that a user can make to have a more expensive vehicle through the scheme.

Property Taxation

‘Mansion tax’

The High Value Council Tax Surcharge (HVCTS) is a new charge on owners of residential property in England worth £2 million or more (in 2026), which will take effect in April 2028.

Homeowners, rather than occupiers, will be liable to the surcharge and will continue to pay their existing Council Tax alongside the surcharge.

The Valuation Office will conduct a targeted valuation exercise to identify properties above £2 million. Revaluations will be conducted every five years.

Properties above the £2 million threshold will be placed into bands based on their property value. Charges will increase in line with CPI inflation each year from 2029/30 onwards.

The surcharge will be £2,500 for properties between £2 million and £2.5 million and rises to £7,500 for properties above £5 million.

Reclaiming VAT on a car – notoriously difficult to claim

The VAT tax rules are clear - input tax cannot be claimed on the purchase of a new or used car that is made available for any private use. However, input tax can usually be claimed on cars used as a tool of a trade such as by a driving school, taxi firm or private car hire business, even if there is minor private use.

This strict rule was tested in a recent tax case of Maddison and Ben Firth T/A Church Farm v HMRC 2002. This case also underlines the importance of documents when submitting a claim to HMRC.

Mr and Mrs Firth were in business registered for VAT as 'subcontracting glam/camping, weddings and events' - mainly organising weddings and other events. The business claimed input tax on the purchase of two new cars, on the basis that they were used exclusively for business purposes and not available for private use. However, the Tribunal agreed with HMRC that there was insufficient evidence to prove a business-only intention. Importantly they came to this conclusion based on the insurance policy which included insurance for 'Social, Domestic and Pleasure' (SDP). Although Mr Firth explained that it was very difficult to obtain insurance without SDP the option was still available and that was enough to refuse the claim. The Tribunal stated that fact that the insurance policies did not cover the carrying of passengers on a commercial charge basis was an important point and refused the claim. Relevant factors quoted in the case were 'who has access to the car and when; what is the likelihood that the car will never be used for mixed business and private journeys; what is the availability of the car; whether the user keeps a log of journeys; whether the car is insured for private use; and whether the vehicle has any peculiar feature or adaptations for a particular kind of business use?'

In addition, although there was a valid council issued private operator licence, private hire was not covered by the policy. It also did not help Mr Firth's case that although an Audi TT has five seats it is, in effect, a two-seat car and as such not a practical car for private hire (one of the exceptions to the VAT rules).

Finally, HMRC refused a claim for the VAT input on a personalised number plate fixed to a motorcycle, finding that it was personalised to include Mr Firth’s first name. The claim was for business advertising but HMRC disagreed and refused the claim as the number plate (BS70 BEN) did not refer to the business named 'Church Farm'.

As ever in such cases, looking at the facts, this case should probably not have reached as far as a Tribunal Hearing. However, this case underlines the importance of 'intention' and of documents in supporting any claim for input VAT.

2025 Autumn Budget - Other measures

Making Tax Digital for Income Tax (MTD IT)

The requirement to file tax returns using MTD IT will come into effect from

6 April 2026. Those initially affected by the rules will be those with annual income from a sole trader business or property, or both together, of £50,000. This will drop to £30,000 from 6 April 2027, and it is intended to expand the rollout to those with incomes over £20,000 by the end of the Parliament. Anyone who will be affected by these rules should make sure they are ready to comply with them in good time: understanding the requirements and making sure that it is possible to comply with them is not something that should be done at the last minute.

However, the Budget included the good news that late submission penalties will not apply for quarterly updates during the 2026/27 tax year for taxpayers required to join MTD IT. The new penalty regime for late submission and late payment will apply to all self-assessment taxpayers not already due to join the new system from 6 April 2027. The government will also increase the penalties due for late payment of self-assessment income tax and VAT from 1 April 2027.

State pension

The State pension will rise by 4.8% from April 2026 in line with average earnings,

in accordance with the ‘Triple Lock’. The government is taking steps to deal with the possibility that the State pension on its own, which is paid without deduction of tax, may exceed the personal tax allowance in 2027/28. The government plans to consult on ways to avoid requiring pensioners with no other sources of income having to report to HMRC and pay tax.

Fuel duty

The Chancellor decided to maintain the freeze in fuel duty and to retain the 5p cut beyond 22 March 2026, when it was supposed to come to an end. It will now be reversed in stages between 1 September 2026 and 1 March 2027. Inflationary increases in the duty are planned to resume in April 2027.

Electric Vehicle Excise Duty

The government is introducing Electric Vehicle Excise Duty (eVED), a new mileage charge for electric and plug-in hybrid cars, with effect from April 2028. Drivers will pay for their mileage on a per-mile basis alongside their existing Vehicle Excise Duty. Electric cars will pay half the equivalent fuel duty rate for petrol and diesel cars, and plug-in hybrid cars will pay a reduced rate equivalent to half of the electric car rate. The government will carry out a consultation to gather views on how this will be implemented.

National Living Wage (NLW)

From 1 April 2026, the NLW which applies to those aged 21 or over will rise from £12.21 per hour to £12.71. There are also increases to the rates that apply to workers aged 18 to 20 (£10.85) and under 18s and apprentices (£8.00).

Universal Credit

As expected, the Chancellor removed the ‘two-child benefit cap’ with effect from

April 2026, increasing the entitlement to Universal Credit for claimants with more than two children. This measure will cost between £2.3 billion and £3.2 billion a year over the forecast period. By contrast, the freezing of income tax bands and allowances

is expected to raise £12.4 billion in the year 2030/31 alone.

Student loans

The repayment threshold for Plan 2 student loans will be frozen at £29,385 for three years from April 2027. This means that graduates are likely to be liable for higher repayments as their income increases above that level, in the same way that freezing income tax thresholds and allowances increases income tax. It will not increase the outstanding loan itself, but it will require faster repayment of it.

Free fuel – Is it a worthwhile benefit?

Many employees see being allowed the use of their own company car as acknowledgement of their status in a company. While the employee will be taxed on the benefit, the tax charge is usually not as high as having to finance the car out of their own savings or taking out a loan. However, should the employer also offer to pay for all fuel (usually via use of a company fuel card), including for personal use, the employee could face a sizeable tax (and NIC) charge. Many company car users are unaware that unless they fully reimburse their employer for private fuel use, they will be taxed on a fuel benefit – even if the private mileage is relatively low. Private fuel use includes commuting to and from work.

Working out the fuel benefit charge

Crucially, the charge is not based on how much fuel is used privately. Rather, it is based on the cost of an average company car (£28,200 for 2025/26) multiplied by the appropriate percentage based on the car’s CO2 emissions.

For 2025/26, the appropriate percentages range from 3% to 15% for cars with CO2 emissions of 1–50g/km to 37% for cars with emissions greater than 155g/km. Diesel cars are charged a 4% supplement on these percentages (although the appropriate percentage is ‘capped’ at 37%).

A table of the specific percentages can be found at:

https://www.gov.uk/guidance/company-car-benefit-the-appropriate-percentage-480-appendix-2#petrol-powered-and-hybrid-powered-cars-for-the-tax-year-2025-to-2026

As an example, the fuel benefit for a conventional petrol BMW 3 Series (e.g. 320i/320d), with CO2 emissions of 155g/km (the most common brand of company car) will be:

Taxable benefit: £28,200 × 37% = £10,434

Therefore, the tax cost of free fuel on this car would be:

- for a basic rate taxpayer – £2,087;

- for a higher rate taxpayer – £4,174; and

- for an additional rate taxpayer – £4,695.

NIC at the taxpayer’s relevant rate will also be levied as the benefit is deemed to be salary, i.e. calculated at 8% for those employees earning over £12,570 a year plus an additional 2% for those taxpayers earning between £12,570 and £50,270

Is this ‘perk’ worth receiving?

Taking the above BMW car as an example, assuming petrol costs £1.37 per litre and the driver gets 10 miles per litre, a basic rate taxpayer would have to drive 15,234 private miles in the tax year to break even (assuming 240 days at work, this equals less than 65 miles a working day). This is the level at which the cost of fuel (15,234/10 x £1.37) is the same as the tax on the fuel benefit. The NIC charge should also be taken into account in this calculation.

Whether the provision of fuel is a ‘perk’ will depend on how much private mileage the employee undertakes in the tax year, the cost of fuel, the appropriate percentage for the car and the rate at which the employee pays tax. In many cases, unless the appropriate percentage is low and private mileage high, free fuel will not be much of a perk.

Using the above BMW car as an example:

Less than 15,234 personal miles per year – the fuel benefit likely not worth it

More than15,234 personal miles per year – fuel benefit might be worth it

Compare this figure with the cost of fuelling a car for the expected annual mileage. If the tax on the fuel benefit exceeds the cost of private fuel, a suggestion would be to ask whether the employer would make an additional salary contribution as compensation for opting out of the fuel scheme.

Note that employees using company vans and having significant private usage could be liable for the fuel benefit, but no calculation is required. The current charge is a flat rate of £769.

Practical point

For many employees, opting out of the fuel benefit and paying for private fuel p

Useful Links

Jointly owned properties and MTD

Unincorporated landlords who had combined property and trading income in 2024/25 of £50,000 or more must comply with Making Tax Digital for Income Tax Self-Assessment (MTD for ITSA) from 6 April 2026. This requires them to keep digital records and make quarterly returns and a final declaration to HMRC using MTD-compatible software.

Where landlords jointly own a property, there are some points to note.

Working out qualifying income

A landlord is only within MTD from 6 April 2026 if their combined property and trading income (before the deduction of expenses) is £50,000 or more in 2024/25

Where a landlord receives income from a jointly owned property, they only need take account of their share of the income from that property in working out their qualifying income. For example, if two brothers jointly owned a house in respect of which rental income of £20,000 was received in 2025/26 which was shared equally, each brother will need to take into account income of £10,000 in working out their qualifying income.

Digital records

Under MTD for ITSA a landlord must keep digital records of their income and expenses. Where a landlord receives income from a jointly owned property, they only need to keep digital records for their share of the income and expenses.

Landlords with income from jointly owned property can choose to simplify their record-keeping by creating less detailed digital records for the jointly let properties. This means creating a single digital record for each category of property income received in an update period and creating a single digital record for each category of property expenses incurred in a tax year. For example, where the landlord receives rent of £1,000, they can either create a digital record for each monthly rent payment or a single digital record of £3,000 for the rent received in the quarterly update period.

Reporting easement

MTD for ITSA requires landlords within its scope to make quarterly returns on property income and expenses using MTD-compatible software.

However, to simplify matters, where a landlord receives income from a jointly owned property, an easement applies under which the landlord can opt not to include expenses that relate to a jointly let property in their quarterly update. Instead, this information is finalised at the end of the tax year.

Making tax digital: Where are we now? - Part 1

Latest developments in making tax digital.

We are now little more than a year away from the phased introduction of making tax digital (MTD) for income tax self assessment (MTD ITSA), as follows:

Annual aggregate turnover (all sources) Implementation date

More than £50,000 5 April 2026

More than £30,000 and up to £50,000 5 April 2027

More than £20,000 and up to £30,000 Before this Parliament ends (2029)

This last new, lowest band was announced as part of the Autumn Statement 2024 on 30 October 2024:

‘The government will expand the rollout of MTD to those with incomes over £20,000 by the end of this Parliament, and will set out the precise timing for this at a future fiscal event.’

Up to that point, many advisers were daring to hope that MTD might perhaps baulk at going lower than the initial £50,000 per annum threshold.

Key points It is perhaps worth emphasising:

• The thresholds are measured across one’s annual gross income across all business sources (i.e., rents are broadly lumped in alongside all trading receipts – but see also below).

• The measurement year for testing whether one is caught for April 2026 (being the start date for those individuals in the vanguard) will be 2024/25, the actual numbers for which may only just have been finalised and filed by 31 January 2026.

• Thus, do the results for 2024/25 (now) dictate the MTD status for 2026/27?

• Likewise, the measurement year for whether MTD for ITSA will apply for the lower £30,000 annual threshold from April 2027 (i.e., 2027/28) will be the actual results for 2025/26.

• But each separate trade and property business* will still need its own set of quarterly returns ‘updates’.

• Once a taxpayer is caught by MTD ITSA, that annual aggregated business turnover will need to fall below the threshold for three successive years in order to break free of its clutches.

*Generally, all property sources are rolled into a single property business; however, one might have separate UK and offshore rental businesses or lettings in different ‘capacities’, such as sole or joint tenancies, as against a full property partnership.

Given that the annual threshold is intended to have fallen to just £20,000 by 2029, one will presumably have to hope for another means of escape, such as business cessation (see also below).

Income boxes and joint property details

HMRC will monitor taxpayers’ incomes and corresponding MTD obligations by reference to specific boxes on their submitted tax returns – the gross trading income and rental receipts sections. This should be reasonably straightforward, but a quirk has arisen in relation to joint lettings.

Landlords holding only a proportion of joint property are, of course, reliant on whoever prepares that property’s accounts for their income and expenditure details. They are also allowed to choose to include only the net income figure from joint lettings in their current-format tax returns (whether as part of a larger portfolio or not).

In July/August 2024, HMRC confirmed that this easement would continue under MTD, despite the risk of the landlord understating their ‘true’ gross annual income by potentially including only the net amounts for co-owned property letting income.

Making tax digital: Where are we now? - Part 2

Audit trail abandoned When the quarterly ‘update’ regime was originally devised, it was intended that each return would report only that quarter’s results, and that any amendments to previous quarters in the tax year would have to be reported in the next available return but flagged separately so that HMRC could track any changes made.

HMRC has since walked back from this approach and announced in November 2023 that each quarterly return will now hold simply ‘year-so-far’ amounts without further analysis into separate quarters, etc.

Quarterly update deadlines On 22 February 2024, the latest regulations then published included that the quarterly updates’ filing deadlines would be extended by two days, to 7 August/November/February/May, thereby aligning with the usual VAT stagger group filing deadline for calendar quarters.

End of the ‘end of period statement’ Did anyone realise that, when the Chancellor announced ‘the end of the annual tax return’ back in July 2015, what he actually planned instead was a ‘final declaration’, plus four quarterly returns (‘updates’) for each separate business of theirs, plus an annual end of period statement for each business to cover all of the usual annual tax adjustments for disallowed expenses, capital allowances, etc?

But never mind because, ever keen to cut down on taxpayers’ administrative burdens, the government has magnanimously decided to remove the proposed end of period statement and just include all those tax adjustments in the final declaration, instead.

Presumably, the government is banking on nobody spotting that the updated final declaration will now function almost exactly like the tax return whose demise was promised almost a decade ago, just now with a load of extra form-filling obligations that nobody outside of HMRC ever asked for.

Exemptions and exclusions The list of specific exemptions from MTD ITSA has grown slightly:

• Trustees;

• Personal representatives of someone who has died;

• Lloyd’s members;

• Individuals without a National Insurance number (announced Autumn Statement 2023); and

• Foster carers (announced Autumn Statement 2023).

However, just because someone is a Lloyd’s name or foster carer does not mean that they are entirely exempt from MTD; if they have ordinary non-exempt sources, they can be ‘caught’ for those. Likewise, the National Insurance Number exemption will, for most people, last only until they receive their notification – usually just before their 16th birthday.

A wider exemption may be accepted where the taxpayer can show that they are unable to comply with the requirements of MTD, such as by reason of:

• old age or infirmity;

• remoteness of location (poor Internet access); or

• religion.

It seems that, so far, HMRC has resisted the temptation to hide the ‘digital exclusion’ application process behind an online application form.

Conclusion The greatest menace in MTD is not the digital filing and reporting, but the digital record-keeping; having to set up and maintain financial records in a manner tailored more to HMRC’s wants than your own business needs. This is the other, as-yet-unseen nine-tenths of the MTD iceberg.

But in promising to drop the entry threshold to as low as £20,000 per annum, the government has signalled to taxpayers (and to software companies) how firmly it has committed us to this project. For now, there are no precise dates on when MTD for ITSA will be extended to partnerships or to companies (‘avoiding’ MTD might soon be one of the few remaining tax-based incentives to incorporate) but, again, keep in mind that partners will not automatically be safe from MTD if they also have non-partnership business interests.

Keeping digital records for Making Tax Digital

Making Tax Digital for Income Tax Self-Assessment (MTD for ITSA) will apply from 6 April 2026 to sole traders and unincorporated landlords with combined trading and property income in 2024/25 of at least £50,000.

Under MTD for ITSA, traders and landlords must keep digital records and make digital returns to HMRC using MTD-compatible software.

A digital record is a record of income and expenses that is created and stored in software that works with MTD for ITSA. Under MTD for ITSA, a trader must keep digital records of their trading income and expenses, and an unincorporated landlord must keep digital records of their property income and expenses. If a trader or landlord has other income, there is no need for them to keep records of that income digitally.

Software

Traders and landlords within MTD for ITSA will need to use software that either creates digital records and submits information to HMRC or software which connects to the trader or landlord’s own record-keeping software, such as a spreadsheet. This type of software is known as bridging software.

Taxpayers can choose a single product that meets all their needs or a number of products that work together. Where more than one product is used, they must link digitally. For example, it is acceptable to keep records in a spreadsheet which is linked digitally to software to submit information to HMRC. However, it is not acceptable to manually enter or cut and paste data from a spreadsheet into a software package.

Records that must be kept digitally

The following records must be kept digitally:

- self-employment income, such as sales, takings and fees;

- self-employment expenses, such as the cost of goods, travel costs, office costs, rent, etc.;

- property income, such as rent, lease premiums, reverse premiums and inducements; and

- property expenses, such as repairs, maintenance, travel, etc.

The amount, the date the income was received or payment made and the nature of the income or expense should be recorded. The income and expenditure categories for MTD for ITSA are the same as for the Self-Assessment tax return.

If a trader has more than one business, they will need to keep the details for each business separately and make separate quarterly returns for each business. Landlords should keep separate records for their UK and foreign property businesses.

Jointly let properties

Where a landlord has income from a jointly let property, they only need to keep digital records relating to their share of the income and expenses. Landlords with income from jointly let properties can opt to keep less detailed records or to exclude income from jointly let properties in their quarterly updates; the income is instead included when the position for the tax year is finalised.

Turnover below the VAT threshold

If a trader’s turnover from a single self-employment is £90,000 or less, they only need to record whether a transaction is income or an expense. More detail is not required.

Landlords with income from residential letting need to record whether a transaction is an income or an expense and, where it is an expense, whether it is a restricted finance cost.

Once income reaches £90,000, transactions must be fully categorised.

Retailers

Retailers can create a digital record of gross daily takings rather than having to record each individual sale.

Storing digital records

Digital records must be kept for at least five years from the 31 January submission date for the tax year in question, i.e. for 2026/27, until 31 January 2033.

New 40% FYA and reduction in WDAs

A new 40% first-year allowance (FYA) is to be introduced from April 2026. It will apply to main rate expenditure on new assets, excluding cars. Both companies and unincorporated business will be able to benefit. The new allowance will be available from 1 January2026 for corporation tax and from 6 January 2026 for income tax.

From 1 April 2026 for corporation tax and 6 April 2026 for income tax the main rate of writing down allowance (WDA) is reduced from 18% to 14%. A hybrid rate will apply where the chargeable period spans the date of the rate change.

Utilising the new allowance

Companies have a range of options for relieving main rate expenditure in the year in which it is incurred. The annual investment allowance (AIA) provides immediate relief for qualifying expenditure on new and used assets and applies to both qualifying main rate and special rate expenditure. However, it is subject to an annual limit of £1 million.

Companies can also take advantage of full expensing to deduct qualifying expenditure on new main rate assets. Full expensing is available without limit.

Like full expensing, the new 40% FYA applies to qualifying expenditure on new main rate assets. As full expensing can be used without limit, the 40% FYA will only be of use to a company where the expenditure is outside full expensing. This will be the case, for example, for assets used for leasing.

The new 40% FYA is also available to unincorporated businesses.

The cash basis is the default basis of accounts preparation for traders. It allows capital expenditure to be deducted when computing profits unless the expenditure is of a type for which such a deduction is specifically prohibited. Cars fall into this category. Where a deduction is not allowed, capital allowances can be claimed (unless simplified expenses have been used to claim relief for mileage costs).

Capital allowances are of more relevance where the trader uses the accruals basis. Unincorporated businesses can access the AIA, but do not benefit from full expensing. The new 40% FYA will be useful to them where the AIA has been used up, and also where expenditure qualifies for the new 40% FYA but not the AIA.

Where the 40% FYA is claimed, the balance of the expenditure is relieved by main rate WDAs.

Reduction in the WDA

The rate of WDA on main rate expenditure drops from 18% to 14% from 1 or 6 April 2026. This will lengthen the period over which relief is given for expenditure on main rate assets. It will have an impact where the business opted not to claim the AIA or full expensing on qualifying main rate expenditure or, from January2026, where the new 40% FYA is claimed.

Cars, other than new zero emission cars, are not eligible for any of the FYAs. Low emission cars are allocated to the main pool. The reduction in the main rate WDA will mean that it will take businesses longer to fully relieve the cost of main rate cars than is currently the case.

Where the chargeable period spans the date on which the rate changes, a hybrid rate will apply. This will reflect the number of days in the chargeable period before the rate change and the number of days on or after the rate change. For example, where a company prepares accounts to 30 June, the hybrid rate for the period to 30 June 2026 is 17%.

Looking ahead to MTD for landlords

The way that many landlords will report details of their income and expenses to HMRC is changing from April 2026 onwards. This is when Making Tax Digital for Income Tax Self Assessment (MTD for ITSA) comes into effect. Landlords who fall within the scope of MTD for ITSA will need to keep digital records, use MTD-compatible software and send quarterly updates to HMRC. This will impose new compliance obligations on them and change the way in which they interact with HMRC.

Start date 1: 6 April 2026

MTD for ITSA will apply to unincorporated landlords and sole traders with trading and/or property income of £50,000 or more from 6 April 2026. When determining a landlord’s MTD start date, it is important to take account of both rental income from unincorporated property businesses and also trading income from unincorporated businesses (such as those operated as a sole trader). However, any rental income from property companies can be ignored. The key figure is the total of both rental and trading income, so a landlord with rental income of £10,000 and trading income of £45,000 will be within MTD for ITSA from 6 April 2026 while a landlord with rental income of £49,000 who has no trading income will have a later start date. The relevant income will be that for 2024/25, as reported on the Self Assessment tax return which must be filed by 31 January 2026.

It is important that landlords with an April 2026 start date make sure that they know how MTD for ITSA will affect them, and that they are ready to comply from 6 April 2026 onwards.

Once within MTD for ITSA a landlord remains within it, even if their income falls to below the trigger threshold, unless it remains below the trigger threshold for three successive tax years.

Start date 2: 6 April 2027

Landlords running unincorporated property businesses will be brought within MTD for ITSA from 6 April 2027 if they have rental income and/or trading income from an unincorporated business of £30,000 or more.

Other landlords

The Government plan to bring unincorporated landlords and unincorporated businesses with rental and/or trading income of £20,000 or more into MTD for ITSA by the end of the current Parliament. As of yet, no date has been set for those whose income is below this level.

Obligations

Currently, where rental income is more than £1,000 (and the landlord is not within the rent-a-room scheme), they must report their taxable profits to HMRC on the property pages of their Self Assessment tax return by 31 January following the end of the tax year to which it relates. They must keep records of their income and expenses, but can do so in a way that suits them.

Under MTD for ITSA this all changes. The landlord will need to keep digital records and use software that is compatible with MTD for ITSA to report simple summaries of income and expenses to HMRC on a quarterly basis. The quarters run to 5 July, 5 October, 5 January and 5 April, although taxpayers can report to calendar quarters instead (30 June, 30 September, 31 December and 31 March). HMRC publish details of commercial software that fits the bill. They have also said that they will make free software available for those with the most straightforward affairs.

After the final quarterly update for the year has been submitted, the landlord will need to make a final declaration to finalise their income tax position for the tax year. This is like the current tax return and it is at this stage that the taxpayer will claim reliefs and allowances, and also reflect other income that they may have which is not within the MTD process, such as savings and investment income and income from employment. The landlord will also need to make a declaration that the information is complete and correct, as is currently the case on the Self Assessment tax return.

There is no change to the way in which tax is paid under MTD for ITSA, only the way in which income is reported.

Keeping digital records for MTD

One of the key requirements under Making Tax Digital for Income Tax Self-Assessment (MTD for ITSA) is the need to keep digital records of income and expenses. A digital record is a record of income or an expense that is created and stored using software that is compatible with MTD for ITSA.

There are different software options available. A landlord within MTD for ITSA can either choose a single software package that does everything or different software products that work together. For example, a landlord could record income and expenses in a spreadsheet that is linked by software (bridging software) to another package for submitting returns to HMRC. It is important to note that where more than one product is used, they are linked digitally. It is not permissible to enter figures manually or to cut and paste from one program to another.

Information that must be recorded

A landlord within MTD for ITSA will need to keep records of property income, such as rent, premiums for the grant of a lease, reverse premiums and inducements, and property expenses, such as repairs, maintenance and cleaning, digitally.

The landlord will need to record the following in their digital records:

- the amount;

- the date on which it was received or incurred; and

- the category into which it falls.

The income and expenditure categories used for MTD for ITSA are the same as for the Self-Assessment tax return.

Different property businesses

If a landlord has both a UK property business and an overseas property business, they will need to keep separate digital records for each business.

Jointly let properties

A landlord with income from jointly let properties only need include their share of the income and the expenses. There is an easement which allows landlords with income from jointly owned properties to keep less detailed digital records.

Turnover of under £90,000

If the landlord’s total property turnover is less than £90,000, they can choose to categorise their digital records in less detail. If a landlord has income from residential lettings, they can record only whether a transaction is an income or an expense, and for expenses, whether the expense is a restricted finance cost.

Property income allowance

Landlords claiming the property income allowance do not need to record this in their digital records. Instead, it is claimed at the end of the tax year when the position for the year is finalised.

Disincorporation of a company

In the not-too-distant past, incorporation was synonymous with automatic tax savings. However, successive governments have eroded these tax benefits. With additional administration and costs, many directors are considering disincorporation. As ever, there are tax implications for both the company and individual.

Asset transfer

Whatever the reason for disincorporation, when a company with assets closes, HMRC generally treats the company as disposing of those assets to the directors at market value. For the company, this would usually crystallise either balancing charges or allowances. However, where there is a business succession between connected parties, a balancing charge or allowance can be avoided by making an election. The effect is for any actual or deemed disposal proceeds to be ignored and for the capital allowance pool to be transferred at its tax written-down value.

A valid election must be made jointly by the company and individual within two years of the date of succession. The succeeding business then includes the transferred closing written-down value as an addition in its opening capital allowance pool. No writing down allowances are given on the purchase of plant or machinery in the company’s final basis period, and a balancing adjustment is calculated.

Transferring stock

Similar to the transfer of assets, the transfer of stock is deemed to be at ‘market value’. However, it should be possible for the parties to make a joint election to transfer the stock at its actual transfer value (or, if higher, the book value).

Capital assets

A company that has been in business for a while may have built up a significant value of ‘goodwill’ when they decide to disincorporate. Goodwill is an asset that will be transferred to the new business along with any other 'relevant' assets (e.g. land and buildings). HMRC usually taxes such a transfer as a chargeable gain, again at market value as the transfer will take place between ‘connected parties’. However, unlike for assets subject to capital allowances, there are no reliefs available to defer or hold over any gains. As such, this tax charge is often the largest hidden tax cost in disincorporation.

Stamp duty land tax

If a property used by a company is transferred to someone connected to the company (e.g. a shareholder who becomes a sole trader), HMRC treats the transaction as if the individual bought at market value, even if no money changes hands. However, if a property is transferred as a distribution in specie (non-cash), this should be exempt from SDLT. This is provided that the property is not encumbered with a loan and the distribution does not give rise to the creation of a debt.

Where there is a third-party (non-shareholder) loan secured on the property, the transfer will attract SDLT where there is an assumption by the shareholder of liability for the debt.

VAT

As a general rule, when a trade ceases the VAT-registered entity is deemed to make a taxable supply of all goods held by the business. However, on a transfer from a company to sole trader, there should be no VAT charged by virtue of the ‘transfer of going concern’ provisions.

Withdrawing monies

There will be the usual considerations (i.e. tax rates and timing, etc.) when deciding how to withdraw any remaining cash from a solvent company, but the outcome will probably be a straight choice between taking a dividend or a capital distribution.

A capital distribution (only available on the company's closure if the total amount paid to all shareholders is less than £25,000), will be subject to CGT taxed at either 18% or 24% for 2025/26, depending on the level of the shareholder’s income. Where the distributable amount exceeds £25,000, the shareholders pay income tax at the dividend tax rates, after taking into account the £500 dividend allowance (and any personal allowance, if available).

Practical point

Disincorporation can be a significant step, so it is advisable to consult professionals to ensure compliance and understanding of the implications.

Mileage allowance payments

To save work, employers can pay employees a mileage allowance if they use their own car for business journeys. The Government have recently cleared up confusion as to what can be paid tax-free, confirming the maximum tax-free amount.

Mileage allowance payments - The approved mileage allowance payments system is a simplified system that allows employers to pay tax-free mileage allowance payments to employees who use their cars for business travel. Under the system, payments can be made tax-free up to the ‘approved amount’.

A similar, but not identical, system applies for National Insurance purposes.

The approved amount - The approved amount for tax is calculated for the tax year as a whole and is simply the reimbursed business mileage for the tax year multiplied by the tax-free mileage rates for the type of vehicle used by the employee. Rates are set for cars and vans, motor cycles and cycles and are as shown in the table below. They have been unchanged since 2011/12.

Example - Mo uses his own car for business and drives 12,350 miles in the tax year. The approved amount is £5,087.50 (10,000 miles @ 45p per mile + 2,350 miles @ 25p per mile).

Any payments made in excess of the approved amount are taxable and must be reported to HMRC on the employee’s P11D. If, on the other hand, the employer does not pay a mileage allowance or pays less than the approved amount, the employee can claim a deduction for the difference between the approved amount and the amount actually paid, if any.

Confusion - Earlier in the year, a petition went before Parliament calling for an increase in the advisory rate from 45 pence per mile to 60 pence per mile to reflect the increases in fuel prices since 2011. Parliament rejected the petition stating that the rates remained adequate as they covered all running costs and the fuel element was only a small part. However, in their response, they pointed out that employers could pay higher amounts tax-free where this represented the amount of actual expenditure and could be substantiated: