01332 202660

v

Services

.png?crc=484381513)

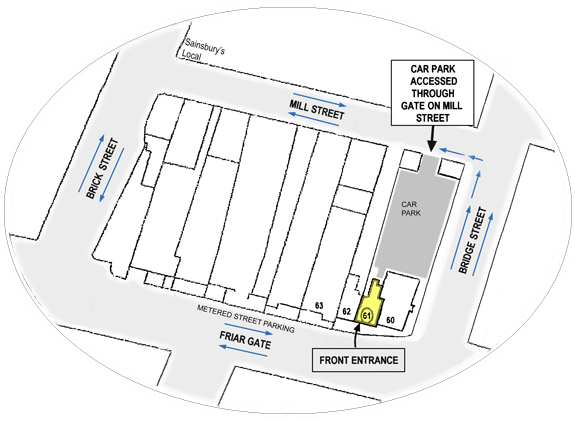

61 Friar Gate Derby DE1 1DJ

Sign

up

Newsletter

Salaries and Dividends

Many small business owners find allocating money between dividends, salary and expense claims difficult and complicated. The advice in this article is geared towards limited company contractors and micro businesses with one or two directors / shareholders.

The Basics

Small company owners are normally both directors and shareholders in their businesses. A director is an employee, and thus entitled to a salary, whereas a shareholding is an investment and thus entitled to a dividend. But whats best for tax purposes?

Historically the tax/NI on dividends v salary wasn’t that different, however the Dividend Tax introduced from 16/17 onwards makes dividends 7.5% more expensive. The big difference however is National Insurance – which doesn’t apply to dividends but does apply to salaries. Subject to IR35 considerations a low salary / high dividend is normally preferred to save NI.

In terms of taking money out of your company, your first priority is settling expenses that you’ve met personally, eg mileage, travel, subsistence – these will be tax free.

Second priority is salary – normally to somewhere around the Personal Allowance level.

Finally, dividend covers the rest of your available profit, or you can leave profit in your company as a buffer. Dividends are paid from company profits after Corporation Tax and and are taxed as personal income via Dividend Tax.

Always make sure tax (PAYE/NI, Corporation Tax and VAT) is provided for and kept separately in the company.

Salary levels

There are no rights and wrongs relating to salary levels, however too high a salary level results in unnecessary NI being paid. The national insurance primary threshold for 2019/20 is £8,632 therefore we would suggest a monthly gross salary of £719 which stays just below this threshold.

Employment Allowance

A key factor on the level of salary a director should get is whether the employment allowance is available for that director or not. The Employment Allowance was increased to £3,000 from £2,000 in 2016/17. But HMRC announced that from 2016/17 onwards the Employment Allowance would not be available to companies where the only employee paid earnings above the Secondary Threshold for Class 1 National Insurance contributions is the director. This means that companies with several employees, where the director is the only employee paid above the Secondary Threshold, will not be eligible for the Employment Allowance. Deliberately avoiding this restriction by adding a spouse to the payroll to meet the criteria will be open to challenge from HMRC.

However, if the spouse genuinely works in the business, then the company should be able to claim the Employment Allowance, subject to them having earnings above the Secondary Threshold for Class 1.

In summary you can’t claim if:

- you’re the director and the only paid employee in your company

- you employ someone for personal, household or domestic work (like a nanny or gardener) - unless they’re a care or support worker

- you’re a public body or business doing more than half your work in the public sector (such as local councils and NHS services) - unless you’re a charity

- you’re a service company working under ‘IR35 rules’ and your only income is the earnings of the intermediary (such as your personal service company, limited company or partnership).

If you can claim the allowance there are three basic options to consider:

- Option 1: Claim the Employment Allowance

- Option 2: Take a salary up to the NI Primary threshold

- Option 3: A tailored option where the director has other income or could generate interest to be paid from the limited company

Option 1: Claim the employment allowance

Take an annual gross salary of £12,500 which is the standard tax free personal allowance for 2019/20.

Your personal allowance may be a bit different if HMRC have adjusted your tax code but to keep it simple we’ll assume the standard £12,500.

This level of salary will not attract any personal income tax, but it will attract some employees national insurance which will total £464.

No employers national insurance will need to be paid as it will be covered by the employment allowance, assuming you can claim it. If you have other employees you will need to consider if their salaries already use up the £3,000 employment allowance, if they do then you would be better going for option 2 below.

With regards to dividends, the higher tax band is £50,000 so assuming you want to stay in the basic tax band this leaves you with £37,500 of dividends to take.

There will be some personal tax to pay on these though – the first £2,000 is tax free but after that they are charged at 7.5% tax.

See below table for illustration:

Gross salary £12,500

Dividends £37,500

Total £50,000

Class 1 Employee (£464.16)

Dividend tax (£2,662.50)

Cash £46,873.34

Option 2: Take a salary up to the NI primary threshold

If you can’t claim the employment allowance or want to keep things simpler this is a good strategy for you.

There are two national insurance thresholds you need to be aware of:

Lower Earnings Limit – as long as you earn salary above this you are protecting your entitlement to future state pension and benefits without paying any national insurance.

Primary Threshold – if you earn above this you have to start paying national insurance

So the idea is to go up to the Primary Threshold.

The national insurance Primary Threshold for 2019/20 is £166 per week or £8,632 for the year.

Therefore we would suggest a monthly gross salary of £719 which stays just below this threshold.

With regards to dividends, assuming as with Option 1 you wish to take dividends up to the higher tax band but no further, then you can take slightly more dividends with Option 2 than with Option 1.

This is because you are only taking £8,628 of salary which leaves £3,872 of dividends that are in the tax free allowance, as well as the £2,000 tax free dividend allowance.

You are not paying any employees national insurance in this scenario which is why you end up with more net income.

The tax calculation for Option 2 is:

Your annual salary is £8,628 so this leaves £3,872 of dividends that can be taken tax free using up the personal allowance.

The next £2,000 of dividends are also tax free as they are within the dividend allowance.

This leaves the balance of dividends of £35,500 taxed at 7.5% = £2,662.50 of tax.

This works out as follows – it actually works out to be the same tax amount as Option 1.

Gross salary £8,628

Dividends £41,372

Total £50,000

Class 1 Employee NIL

Dividend tax (£2,662.50)

Cash £47,337.50

You will note that the net cash in pocket after income tax and employees national insurance is actually slightly higher in Option 2 than Option 1, by £464.16, however this doesn’t factor in the additional corporation tax you save on the higher gross salary in Option 1.

Option 3: A tailored option

If the director has other income (eg. rental income) then a more tailored approach is required and one needs to consider the level and type of the other income, and also take into account whether the Employment Allowance will be used up against other staff salaries. Also, one should keep in mind that if the director is claiming the remittance basis, he will have lost the Personal Allowance and the benefit of a salary becomes then questionable.

A few of the possible tax planning options to consider are listed below:

- Transfer shares to spouses to take advantage of the dividend allowance

- Set up a rental agreement with your company for claiming ‘use of home as office’ expenses

- Make pension contributions from the company

- Extract money as interest income from the company

The tax calculations involving savings income are very complicated. HMRC are unable to do the calculation properly in some instances and require tax payers to file their returns on paper in those cases.

We will normally base payroll for clients on these figures but clients are welcome to instruct as at higher or lower levels, eg some directors prefer a higher salary level, eg £24,000 or £36,000 as they are more comfortable with this ethically.

Dividend levels and administration

So long as there is adequate tax reserve in the company, dividends can be as high and as frequent as you like – however best practice is to limit them to monthly or quarterly.

If you are a Higher Rate tax payer there is often no merit in drawing dividends from your company just to hold the cash personally – you can defer the Higher Rate tax by leaving the money in the company undrawn. In a future year it may be possible to withdraw it more tax efficiently if you are taking some time off for example.

Some of our clients like to restrict their drawings to the starting level of the Higher Rate tax bracket each year.

A few points on dividends:

- Its good practice to minute dividends and prepare vouchers, however in practice a bank payment from company to shareholders counts as a interim dividend.

- Dividends can only be paid from profits – and you should make sure the company has sufficient profits before paying one. In practice, for a small business without trade creditors or debtors, cash is a good proxy for profit in most cases.

- Dividends must be split according to shareholding percentages, and its good practice to make separate payments to each shareholder, even if they are husband and wife. You can pay differential dividends using waivers or alphabet shares, but you need to take advice on these tools as they have pitfalls for the unwary.

- An interim dividend is approved by the directors, whereas a final dividend is approved by the shareholders with the annual accounts. In practice, most dividends will be interim ones paid in year at the directors behest. The main point to note though is that if a dividend is accrued in the year end accounts but not paid, then normally its considered as approved on the date the accounts were approved, which can shift it into a later tax year unexpectedly.

- Think about the impact on benefits, eg. the High Income Child Benefit Charge.

Income Shifting

Dividends are paid to shareholders in proportion to their shareholdings. There are useful tax savings available by bringing in another family member, normally spouse or partner, if they have unused allowances.

However in these situations considerations need to be given to the “Income shifting” rules – these are currently on the back burner but this cannot be relied on long term.

Contact us or send us feedback

Whether it is answering questions, making an appointment, or pointing you in the right direction, we look forward to hearing from you.

You can email us below:

Adrian Mooy & Co Ltd - 61 Friar Gate Derby DE1 1DJ - adrian@adrianmooy.com

Map

BACK ENTRANCE

FREE PARKING IN OUR CAR PARK

The Greyhound

Adrian Mooy & Co is the trading name of Adrian Mooy & Co Ltd. Registered in England No. 05770414.

Registered office: 61 Friar Gate, Derby, Derbyshire, DE1 1DJ