a friendly service covering audit, tax, accounts, self assessment,

VAT & payroll please contact us.

New clients - easy three step process

Contact us

- Visit our office

- Request a callback

- Submit an enquiry

- Call us

- Email us

Building a relationship

- Initial consultation

- Understanding your

personal or business circumstances and requirements

Get a fixed fee

- Written Service Proposal

- Service breakdown

- Fixed fee quote

- Issue an Engagement

Letter

We offer cloud-based accounting solutions. Using good technology saves time. With the power of cloud accounting in your hands, you can access accurate real-time data on the go, accept instant payments and even automate repetitive tasks like invoicing. Fast, easy, touch-of-a-button software can make a real difference to the way you run your business.

Helping you grow your business

Helping you keep more of your income

We understand your needs

Adrian Mooy & Co - Accountants Derby

Welcome to Adrian Mooy & Co Ltd

Call us on 01332 202660

Receive our

Newsletter

... a digital firm using the best tech to help our clients

like yours grow and be more profitable.

We offer a personal service and welcome new clients.

We are a firm of Chartered Certified Accountants

and tax advisors in Derby helping businesses

From start-up to exit & everything in-between.

Whether you’re struggling with company formation,

KASHFLOW

+

SNAP

IRIS

OPENSPACE

SAGE

MAKING

TAX

DIGITAL

XERO

+

DEXT

CHASER

FUTRLI

FLUIDLY

GO

CARDLESS

annual accounts and taxation, payroll or VAT you can

count on us at every step of your business’s journey. For

02/12/2015

Writer Name

Blog Post Title

Read more

Services

We offer a range of high quality services

Self-employed sole traders

If you are starting your own business, running it as a sole trader is the quickest and easiest way to do it. However, you will have unlimited liability which means you are personally responsible for business debts.

Another important aspect is that you are taxed on all the profits with little opportunity for tax planning. This is why most businesses will incorporate as profits increase.

We can support you through business registration and provide advice on all aspects of tax including:

◦ Accounts for HMRC ◦ Self assessment ◦ VAT returns ◦

◦ Payroll services ◦ Tax planning ◦

Partnerships

Partnerships are similar to sole trades, except that they are used when more than one person owns the business.

Each profit share is determined by the partners and best practice is to record this in a partnership agreement.

With partnerships each partner has joint and several liability for the debts of the partnership, so that if one partner cannot pay their share of any business debts, the debt will fall on the other partners.

Setting up a partnership agreement from the outset is essential.

Limited companies

Corporate tax planning can result in significant improvements in your bottom line. Our services will help to minimise your corporate tax exposure.

Services include:

- Determining the most tax effective structure for your business

Self assessment

Self assessment tax returns are becoming increasingly complex and failing to submit your return on time, or correctly, can result in substantial penalties.

We use the latest tax software to ensure that tax returns are completed efficiently, accurately and on-time.

Self assessment: Taking

away the hassles of tax

We provide a comprehensive personal tax compliance service for individuals that includes:

- Completing your personal tax return

- Calculating your liability for the year and advising you of the due dates for payment

- Dealing with claims to reduce payments on account, which can be beneficial

- Dealing with HM Revenue & Customs investigations and aspect enquiries

Contractors & IR35

Invoicing your contracting work through a limited company is tax efficient. We will advise you on how to structure your contract to minimise IR35 risk. We will ensure you claim all the expenses that you are entitled to and work out if you can save money by joining the VAT Flat Rate Scheme. We will complete your accounts and tax returns and provide you with clarity over your tax payments.

Included in the service • IRIS KashFlow + Snap • Annual accounts • Corporate tax return • Personal tax return • Payroll • Dividend administration • VAT returns • Contract reviews • Dealing with HMRC

VAT, payroll, CIS & bookkeeping

VAT • is one of the most complex tax regimes imposed on business. We provide a cost effective service including assistance with registration & completing your returns.

Payroll • Administering your payroll can be time consuming. We provide a comprehensive payroll service.

Your Payroll Solution

Construction Industry Scheme • CIS returns & payments

Book-keeping • Maintenance of accounting records

Provision of management accounts

For more about these services please contact us.

Keeping the Books

Audit & assurance

Assurance

If your business does not require a statutory audit then our Assurance Service will provide reassurance that your accounts stand up to close scrutiny from your bank or other finance providers.

Work is tailored to your specific requirements and the level of confidence that you are looking to achieve and will provide credibility to your accounts by the issuing of an assurance review report.

Audit

We strive to provide an auditing service that adds more value than merely the statutory compliance requirement of an audit.

We tailor the audit to meet your circumstances and needs. Using the latest techniques and software we deliver a cost-effective audit that provides real value.

Business start-up advice

Before starting out you may need help with business planning, cash flow and profit & loss forecasts.

You may also want help identifying the best structure for your business. From sole trades and partnerships to limited companies and limited liability partnerships, we have the experience to advise on the best solution for you both operationally and from a tax point of view.

We also advise on accounting software selection, profit improvement, profit extraction & tax saving.

If you wish to know more about our Business Start-up service please contact us on 01332 202660.

Landlords & property

Accountancy and taxation of property is a specialist area. We have the expertise and experience to work effectively with private landlords and property investors. We deal with self-assessment tax, accounts preparation & tax advice for all aspects of property portfolios.

Whether you are a first time buy to let landlord or a long established developer we will discuss and understand your situation in order to advise and recommend the most appropriate medium through which to carry out your property investments. We will guide you through the accounting and tax issues and help you to plan effectively.

- Tax returns

- Property accounts

- Company accounts

- CGT and income tax planning

- VAT advice

Accounts services

Annual Accounts Preparation

We take the time to explain your accounts to you so that you understand what is going on in your business.

Management Accounts

Up to date, relevant and quickly produced management information for better control.

As part of our accounts service we prepare your annual accounts and complete yearly personal and business tax returns.

As your year-end approaches we will agree a timetable with you for completion of the accounts that minimises disruption to your business and leaves no late surprises when it comes to your tax liabilities.

We can also prepare management accounts to help you run your business and make effective business decisions. Management accounts are also very useful when approaching lending institutions when no year end accounts are available. We offer:

- Monthly or quarterly management accounts

- Budgeting and forecasting

- Management reports identifying key variances and recommendations

For a meeting to discuss your requirements please call us on 01332 202660.

Accounts

Tax services

Our objective is to ensure you pay the minimum tax required by law.

Corporation tax

We understand the issues facing owner-managed businesses.

Self Assessment

We provide advice on personal tax & planning opportunities.

Everyone who is subject to tax needs professional advice and support if they are to optimise their tax position and ensure they meet the compliance requirements.

Corporation tax services

Under Corporation Tax Self Assessment the legal responsibility for correctly calculating the corporation tax liability falls on business owners. We will help to minimise corporate tax exposure and relieve the administrative burden of compliance with current tax legislation.

Personal tax services (including sole-traders and partnerships)

We take the headache out of Self Assessment and provide you with practical advice on personal tax and the planning opportunities available to you. Over recent years HMRC have increased the penalties for failing to file a return on time and for errors. We complete tax returns, calculate any tax liability and advise you on exactly when to make payments.

Payroll

Running a small business places many demands on your time. We can help lift the load with our complete payroll service.

Designed to ease your administrative burden, our service removes what is often a time consuming task, leaving you free to concentrate on managing your business.

Meeting your obligations as an employer can be daunting especially with the introduction of Real Time Information (RTI).

Throughout the year, we will calculate your employees' net pay, report the relevant information to HMRC and provide you with payslips for your staff. Late payments or underpayments of employers' deductions can now lead to hefty penalties.

We can also prepare your benefits and expenses forms and advise you of any filing requirements and national insurance due. Benefits and expenses can be a complicated area and knowing what to report can be tricky.

We can file all your in-year and year end returns with HMRC and provide you with P60s to distribute to your employees at the year end.

We also offer a solution to meet your auto-enrolment obligations.

VAT

Guiding you through the complexities of VAT

Businesses dealing with the requirements of VAT legislation will agree that this is often a complex area.

Our VAT services cover all the basics, helping you to meet your obligations. Contact us to see how we can help you.

Determining whether you need to register for VAT, handling the administration of your returns and ensuring you are paying the correct amount of VAT can be both time consuming and complicated.

Our compliance services offer support for all stages of completing your VAT returns, whether you need advice on the treatment of specific transactions or have produced your records and would like verification that they are correct.

We can also advise on the pros and cons of voluntary registration, extracting maximum benefit from the rules on de-registration and the Flat rate VAT scheme.

Our consultancy service guides you through the intricacies of the legislation, pinpointing areas where you may be able to relieve or partly relieve the cost of VAT for your business, for example when purchasing new equipment or undertaking new projects such as property development.

For a meeting to discuss VAT and obtain further advice please call us on 01332 202660.

Tax planning

Corporate tax planning

We can conduct a full tax review of your business and determine the most efficient tax structure for you.

Personal tax planning

We give personal tax advice to a wide variety of individuals, including higher rate tax payers, company directors & sole traders.

We can help with tax planning to ensure that the tax impact of a strategy is considered.

Efficient tax planning can make a significant difference to the amount of tax that ultimately becomes payable. We constantly review developments in taxation and are always on hand to add our expertise to any planned course of action or transaction to achieve maximum tax efficiency.

We can assist with:

- Business structuring and profit extraction

- Capital Gains Tax planning

- Tax efficient restructuring

- Trust tax planning

- Wealth protection, including Inheritance Tax planning & Pensions planning

For a meeting to discuss your requirements please call us on 01332 202660.

Tax

Planning

Web-based accounting

Xero is a web-based accounting system designed with the needs of small business owners in mind.

It can automatically connect to your bank and download your bank statements. From there it’s simple to tell Xero what transactions relate to and once told it remembers and looks out for similar transactions. This saves time and makes keeping your accounts up to date easier.

Log in from any web browser. As your accountant we can log in and provide help.

Log in from any web browser. As your accountant we can log in and provide help.

Making Tax Digital - VAT

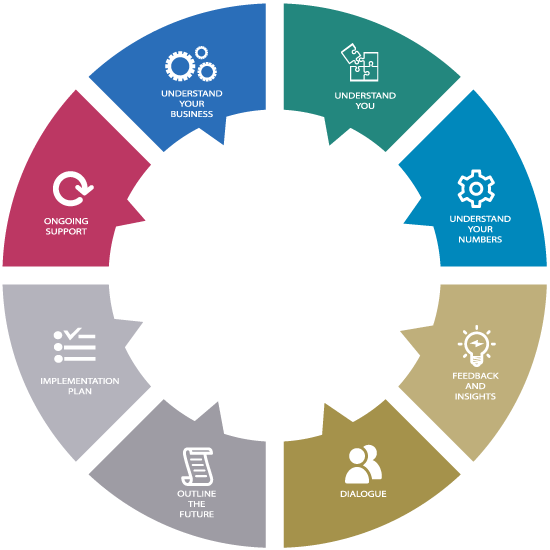

Our Process

Understand your needs

Firstly we listen and gain an understanding of your business and what you are aiming to achieve.

Continuous improvement

We seek your opinions on the service we provide and respond to feedback in order to upgrade and improve what we do.

Build a relationship

Success in business is based around relationships and trust. Our objective is to develop and build strong relationships with our clients, based on two way trust and respect.

Confirm your expectations

Our aim is to help you maximise your business potential and we tailor our service to meet your requirements and agree a timetable for delivering them.

Actively communicate

Communication is important to the success of any commercial venture. It is therefore a vital part of our work with you, sharing the knowledge and ideas that help you to realise your ambitions.

Our Process

Understand your needs

Confirm your expectations

Actively communicate

Build a relationship

Continuous improvement

Straightforward and easy to deal with Adrian Mooy & Co provide an efficient, friendly and professional service - payroll, tax returns, annual accounts and VAT returns are always done on time. Eddie Morris

Call us on 01332 202660

Testimonials

First class! Super accountant! We have been with Adrian Mooy & Co since 1994. They provide a prompt, accurate & reliable service. There is always someone at the end of the phone to help and advise us. They have always delivered and we are more than happy to recommend them. Ian Cannon

Helpsheets

Business property relief - be aware of the pitfalls

Business property relief (BPR) is one of the more valuable tax reliefs available to business owners because it reduces the value of an estate for IHT purposes on both life and death transfers.

The amount of BPR available is:

100% BPR for:

- an unincorporated business, such as a sole trader;

- an interest in an unincorporated business, such as a partnership;

- shares in an unlisted company, including companies listed on the Alternative Investment Market.

50% BPR for:

- shares in a quoted company which give at least 50% of the voting rights;

- land, buildings and/or machinery used in an unincorporated business in which the deceased had an interest or in a company controlled by the deceased.

Many owners assume that just because they have shares in a company, for example, no IHT will be due on their share of the company (100% BRP relief). However, it is easy to get into a situation where this is not the case as two conditions need to be fulfilled. At first reading, these conditions look easy enough to fulfil however, delve further and problems can arise.

The two conditions are:

- the shares need to have been owned for at least two years; and

- the company must carry on a 'trading' business rather than an 'investment' business.

Problem 1 - too much cash

Assets not used 'wholly or mainly' for the business during the last two years, or not required for future business use cannot come under the claim – importantly, included here are high levels of cash. HMRC considers 'excessive' cash balances to be 'excepted' assets. As a general rule, any cash that is more than is reasonably needed for a business's present and future requirements is likely to be treated as excessive. For example, money needed to service delays in customer payments would come within the realms of 'future business use'. However, HMRC would expect to see firm plans in place as to intention (e.g. for business expansion). Should withdrawal of monies be possible then the shareholder may have to weigh up the tax cost of loss of BPR against the cost of extracting cash from the business in the form of salary or dividend.

If the company owns assets mainly used privately, these will reduce the value eligible for BPR in the same way as the cash balance.

Problem 2 - binding agreements

One common problem is where there is a shareholder's agreement in place such as a provision for the surviving shareholders to purchase the shares of a deceased shareholder for the deceased's estate. In this situation, HMRC will argue that this constitutes a binding contract for sale and deny BPR. The advantage of such clauses is that they restrict shares from being acquired by anyone other than the current shareholder owners. A way to counter this is to replace such a clause with a cross-option agreement, where the surviving shareholders have the option to buy the shares and conversely, the estate has an option to sell them. The sale will depend on either option being exercised and so cannot be a binding contract.

Other Problems

BPR will be denied in other circumstances, the usual one being if the company deals mainly in land and buildings e.g. the shareholders of an owner-managed company primarily operating a rental property business.

If a business partner retires but retains a financial interest in the capital account. In this case, BPR will not be available because the retiree will be a creditor of the business.

Spring Budget 2024

The Chancellor used the 2024 Spring Budget to announce some wide-ranging reforms with a couple of tax cuts and new relief across a range of different taxes.

- A 2% reduction in the rate of National Insurance Contributions.

- A 4% reduction in Capital Gains Tax for higher rate taxpayers disposing of residential property.

- The abolition of the Furnished Holiday Lettings regime.

- Reform of non-domicile taxation.

- The VAT threshold will also rise by £5,000.

National Insurance Contributions (NICs)

From 6 April 2024:

- The main rate of employee Class 1 NICs is reduced by 2%, from 10% to 8%.

- The main rate of self-employed Class 4 NICs is also reduced by 2%, from 8% to 6%.

Land & Property

Capital Gains Tax (CGT) Rate for Residential Property Sales

From 6 April 2024

- A reduction in the higher rate of CGT from 28% to 24% for sales of residential property.

- The lower rate of tax remains at 18% for any gains that fall within an individual's basic rate band.

Furnished Holiday Lettings Tax Regime

From April 2025 The Furnished Holiday Lettings tax regime is to be abolished.

Stamp Duty Land Tax (SDLT)

From 1 June 2024, with transitional rules for contracts exchanged on or before 6 March 2024.

The abolition of abolition of Multiple Dwellings Relief (MDR) from Stamp Duty Land Tax (SDLT).

SDLT: Acquisitions by Registered Social Landlords and Public Bodies

A technical change to the SDLT legislation to remove some out-of-date definitions will ensure public bodies will be removed from the scope of the 15% SDLT higher rate charge where the effective date of transaction (usually the date of completion) is on or after 6 March 2024.

SDLT First-time Buyers' Relief

A change to the conditions for First-time Buyers' Relief to assist the victims of domestic abuse who use a nominee or bare trust arrangements to prevent former partners from finding their new address were previously unable to claim relief.

Investment Zones

• Six new English Investment Zones will be created: Greater Manchester, Liverpool City Region, North East of England, South Yorkshire, West Midlands and Tees Valley.

• The duration of Investment Zones will be extended from five to ten years in Scotland and Wales, with details of their four zones being announced later this year.

• Details on the Northern Ireland Enhanced Investment Zone will also be published soon.

See Spring Budget 2024: Land & Property

Overseas and Residence

Non-domiciled taxpayers

From 6 April 2025:

• The remittance basis will be abolished and replaced with a new opt-in residence-based regime.

◦ Individuals in the new regime will not pay UK tax on foreign income and gains for the first four years of UK tax residence.

◦ Transitional rules will apply to existing individuals claiming the remittance basis.

• Overseas Workday Relief will be reformed with eligibility for the relief based on the new residence-based regime.

• Inheritance Tax will also move to a residence-based regime, with a 10-year exemption and 'tail-provision' periods for arrivers and leavers.

Income tax claims and reliefs

Higher-Income Child Benefit Charge (HICBC) Reform of the Higher-Income Child Benefit Charge and the creation of a household-based system from April 2026.

• Threshold raised from £50,000 to £60,000 and bring the taper up to £80,000 from £60,000.

Gift Aid

Corporation Tax

Extension to Full Expensing for leasing

From TBC:

• Draft legislation will be published shortly to extend Full Expensing and the 50% First Year Allowance (FYA). to expenditure on assets for leasing.

• The extension will take place when fiscal conditions allow.

VAT

Registration/deregistration thresholds increase by £5,000

From 1 April 2024

• The VAT registration threshold increases to £90,000 from £85,000.

• The VAT deregistration threshold increases from £83,000 to £88,000.

VAT DIY Housebuilders: new information powers

From the date of Royal Assent to Spring Finance Bill 2024 Additional powers for HMRC to request further evidential documentation about a DIY housebuilder’s claim.

Inheritance Tax (IHT)

From 6 April 2025 at the earliest Inheritance Tax will move to a residence-based regime, with a 10-year exemption and 'tail-provision' periods for arrivers and leavers.

Reclaiming VAT on a car – notoriously difficult to claim

The VAT tax rules are clear - input tax cannot be claimed on the purchase of a new or used car that is made available for any private use. However, input tax can usually be claimed on cars used as a tool of a trade such as by a driving school, taxi firm or private car hire business, even if there is minor private use.

This strict rule was tested in a recent tax case of Maddison and Ben Firth T/A Church Farm v HMRC 2002. This case also underlines the importance of documents when submitting a claim to HMRC.

Mr and Mrs Firth were in business registered for VAT as 'subcontracting glam/camping, weddings and events' - mainly organising weddings and other events. The business claimed input tax on the purchase of two new cars, on the basis that they were used exclusively for business purposes and not available for private use. However, the Tribunal agreed with HMRC that there was insufficient evidence to prove a business-only intention. Importantly they came to this conclusion based on the insurance policy which included insurance for 'Social, Domestic and Pleasure' (SDP). Although Mr Firth explained that it was very difficult to obtain insurance without SDP the option was still available and that was enough to refuse the claim. The Tribunal stated that fact that the insurance policies did not cover the carrying of passengers on a commercial charge basis was an important point and refused the claim. Relevant factors quoted in the case were 'who has access to the car and when; what is the likelihood that the car will never be used for mixed business and private journeys; what is the availability of the car; whether the user keeps a log of journeys; whether the car is insured for private use; and whether the vehicle has any peculiar feature or adaptations for a particular kind of business use?'

In addition, although there was a valid council issued private operator licence, private hire was not covered by the policy. It also did not help Mr Firth's case that although an Audi TT has five seats it is, in effect, a two-seat car and as such not a practical car for private hire (one of the exceptions to the VAT rules).

Finally, HMRC refused a claim for the VAT input on a personalised number plate fixed to a motorcycle, finding that it was personalised to include Mr Firth’s first name. The claim was for business advertising but HMRC disagreed and refused the claim as the number plate (BS70 BEN) did not refer to the business named 'Church Farm'.

As ever in such cases, looking at the facts, this case should probably not have reached as far as a Tribunal Hearing. However, this case underlines the importance of 'intention' and of documents in supporting any claim for input VAT.

NIC implications of being both self-employed and employed

With the cost-of-living crisis upon us more people are considering self-employment as well as employment to bring in extra money. This can lead to overpayments of National Insurance Contributions (NIC) as although tax is paid on aggregate income, NIC's are different, being charged on each source. Class 1 NIC will be paid on the employed earnings with class 2 and/or class 4 NIC being levied on the self-employed earnings. There is a maximum amount of NIC payment for any tax year but you could find that you have overpaid by the end of the year.

Maximum amount

There are two annual maxima for those who are both employed and self-employed. One is in respect of Class 1 and Class 2 NIC's payable, the other refers to the maximum amount of Class 4 NIC's payable by a contributor liable to Class 1, 2 and Class 4 NICs. For the tax year 2022/23 the calculation of the annual maximum has been complicated by the multiple changes in the year to include first the increase in the main and additional rates of Class 1 and Class 4 NIC from 6 April 2022, then the increase in the Class 1 primary threshold and Class 4 lower profits limit introduced in July 2022 and finally the repeal of the changes as contained in the Health and Social Care (repeal) bill.

The regulations provide three different sets of calculations in order to calculate the maximum amount payable for each of the two annual maxima. Depending upon the level of a contributor’s profits and the amount of Class 1 and 2 NIC's paid, the maximum amount of Class 4 NICs due will vary. Different calculations are necessary because of the need to ensure that all contributors pay at least 3.25% (2022 to 2023 tax year) of profits in Class 4 NICs. Detailed worked examples can be found in the HMRC National Insurance Manual.

Reclaiming overpaid NIC

When and how any refund is calculated and claimed will depend on type of NIC overpaid:

Where having more than one employment has resulted in an overpayment the refund claim needs to be in writing within six years of the end of the affected tax year, (although where a reasonable excuse exists, HMRC may allow a later claim)

there is no time limit to the claim where excess contributions have arisen due to the taxpayer being both employed and self-employed. HMRC states that they will calculate the amount due from the information submitted on the tax return and employers' payroll submissions. Taxpayers will then be advised as to any over payment. However, many taxpayers may prefer to calculate the correct Class 2/4 NICs themselves and include those figures on their tax return.

Refunds of overpaid NIC will be made in the following order:

1. Class 4.

2. Class 1 at reduced rate.

3. Class 2.

4. Class 1 at standard rate.

Deferment of NIC

Some contributors may be aware of the likelihood of NIC overpayment in the coming tax year (where there is more than one employment or the taxpayer earns £967 or more per week from one job over the tax year or £1,157 or more per week from 2 jobs over the tax year) and can apply for deferment of Class 1 NIC. Under deferment the contributor continues to make full contributions for one employment whilst paying a reduced rate of 3.25% on weekly earnings between £190 and £967 on the other (instead of the standard rate of 13.25%). Once a year the Contributions office calculates the final NIC bill issuing a demand for any balance thereby preventing overpayments. Deferment of Class 2/4 is no longer possible. Although HMRC supply a ‘breakdown of each class payment’ in their calculations, the schedule is not in sufficient detail that taxpayers who are employed and self-employed can be certain that the correct amount is being charged. Therefore such information will need to be requested.

Dividend ‘traps’ to avoid

Where the plan is to pay a dividend the director/shareholder must ensure that set procedures are in place. This article describes some traps for the unwary and what can be done to reduce the likelihood of HMRC enquiries into dividend payments made.

Trap 1- Timing

The relevant date for an interim dividend is either the actual date of payment (because a dividend resolution is not needed to confirm payment) or the date the payment is placed at the directors/shareholder's disposal. However, unless a resolution is signed and dated, HMRC will consider the payment date to be the date that the payment is entered into the company’s books. This could be a problem should the year of declaration be a year when the shareholder is a basic rate taxpayer but through slack record keeping the dividend is taxed in the next year when the shareholder may be a higher rate taxpayer. This ‘trap’ is more likely to occur in respect of an interim dividend because a final dividend only becomes an enforceable debt when approved by resolution at a general meeting of shareholders. Therefore the relevant date for a final dividend is the date of declaration, the date for which can be planned.

Trap 2 - PHI Insurance

Drawings in the form of dividends together with a low or nil salary could cause problems should the director claim under a Permanent Health Insurance policy. Such policies invariably pay out only on a percentage of earnings when the policyholder cannot work through illness or accident. Therefore it is recommended that the policy be reviewed to check that account is taken of dividend income as well.

Trap 3 - Correct paperwork

HMRC has been known to investigate disparities between dividends declared on a personal tax return with shareholdings declared at Companies House, raising penalties for incorrect returns. Proof in the form of a paper trail of dividends declared and share certificated can be vital as the recent tax case of Terence Raine v HMRC 2016 UKFTT 0448 (TC) showed..

The company, of which Mr Raine and his colleague were directors, was set up by an agent. They were under the impression that each was holding one share and one would be appointed as the director and the other the company secretary. However, the paperwork was completed such that, technically, one share remained in the agent's name. For 10 years, Annual Returns (now 'Confirmation statements') were submitted to Companies House which showed that Mr Raine held all the shares and the accounts confirmed this.. Every year, dividends were declared and paid with supporting counterfoils showing an equal split of share ownership. Eventually, HMRC checked the dividends declared against those shareholdings shown on the Annual Return and saw that they differed. The tax tribunal concluded that Raine must have been aware of the discrepancy, as he was the director who had signed the accounts. Therefore the tax demand and penalties that would have been paid as per the paperwork (namely, all taxable on Raine) were valid.

Giving away the buy-to-let to save inheritance tax

Where a person has a property portfolio, they may consider giving away one or more of their investment properties during their lifetime to reduce the inheritance tax payable on their estate. However, inheritance tax cannot be considered in isolation, as there may also be capital gains tax consequences which need to be taken into account.

We take a look at some of the issues.

Inheritance tax

Inheritance tax is payable on the estate to the extent that it exceeds the available nil rate bands. Each person has a nil rate band of £325,000. A surviving spouse or civil partner’s estate can also benefit from the unused proportion of their spouse/civil partner’s unused nil rate band. This must be claimed. They can also benefit from any unused residence nil rate band, which is available where a main residence is left to a direct descendent.

For inheritance tax purposes, gifts fall out of account if they are made more than seven years before death. The gift is known as a ‘potentially exempt transfer’ (PET) as inheritance tax will only be chargeable if the donor dies within seven years of making the gift.

Where the gift is made at least three years before death, taper relief applies, reducing the inheritance tax payable on the death estate. This can have unintended consequences.

The nil rate band is applied to shelter gifts in the order in which they are made. This can act to reduce the IHT-saving properties of the nil rate band. For example, if a gift is made between 6 and 7 years before death, taper relief will mean that the effective IHT rate on the gift is 8%. However, if the gifts falls within the nil rate band, no inheritance tax will be payable. Consequently, that portion of the nil rate band will only save tax at 8% rather than at the 40% that would be payable on a gift made at death or within three years of death.

To enhance the likelihood of a lifetime gift being free of inheritance tax free (and to maximise the tax-saving potential of the nil rate band), it should be made earlier rather than later.

Capital gains tax

Making a lifetime gift of an investment property can be effective for saving inheritance tax, but it may trigger a capital gains tax liability. If the gift is made to a connected person, such as child, there will be a deemed disposal at market value, and capital gains tax will be payable on the gain. Further, gifting the property will mean that there are no sale proceeds from which to pay the tax.

This may not be a problem, and indeed can be beneficial, if the value has fallen and the disposal will give rise to a loss. Even a gain may not be problematic if it can be sheltered by allowable losses or the available annual exemption, or if the tax payable is small enough to warrant the potential inheritance tax saving.

If there is a gain, a higher rate taxpayer will pay tax on it at 28%. If the donor survives seven years, there will be no inheritance tax to pay. Where this is the case, making a lifetime gift and paying capital gains tax at 28% on the gain will be cheaper than gifting the property at death and the estate paying inheritance tax at 40% on the full value at the date of death. Where the gift is made at death, there is no capital gains tax for the estate to pay – there is a tax-free uplift at death.

However, if the donor does not survive seven years, there may well be inheritance tax and capital gains tax to pay, particularly if the value of the property exceeds the nil rate band. This may significantly increase the total tax payable.

It should also be remembered that on lifetime gift the donee will acquire the property at market value and will pay capital gains tax on any gain that they make on their disposal unless they occupy the property as their only or main residence. Where the property is acquired at death, their base cost is the market value at the date of death.

Weigh up the pros and cons

There is something of a gamble here as the tax outcome will depend on whether the donor lives seven years from the date of the death. It is a question of weighing up the different options and deciding what risks are worth taking to potentially save tax.

Are you able to claim small business rate relief for your FHL?

Holiday homes and holiday lets are treated differently – holiday lets are liable for business rates while holiday home owners must pay council tax. This can work to the landlord’s advantage, particularly if small business rate relief is available. However, owners of holiday properties should be warned – new rules are coming into effect from April 2023 to ensure only those properties that are actually let as holiday accommodation will be within business rates rather than council tax.

Nature of business rates

Business rates are charged instead of council tax on non-domestic properties. This includes residential properties let as furnished holiday lettings on a commercial basis.

The rates are worked out by multiplying the rateable value by the multiplier for the year.

The standard multiplier applies to properties with a rateable value of £51,000 or more. For 2022/23 this is 51.2 pence in the pound (52.4 pence in the pound in London). The small business multiplier applies to properties with a rateable value of less than £51,000. For 2022/23 this is set at 49.9 pence in the pound (51.1 pence in the pound in London).

Properties with a rateable value of £15,000 or less may qualify for small business rate relief. This may mean that you do not need to pay any business rates on your holiday let.

Small business rate relief

Small business rate relief is available on business properties with a rateable value of less than £15,000. However, you will usually only benefit if you only have one business property.

Business with only one property that has a rateable value of £12,000 or less benefit from 100% business rate relief. This means that if you have a single furnished holiday let, you will not pay any business rates as long as the rateable value is not more than £12,000.

If the rateable value falls between £12,000 and £15,000, the relief tapers from 100% for properties with a rateable value of £12,000 to nil for properties with a rateable value of £15,000. So, if your property has a rateable value of £13,500 you will receive a 50% discount on your business rates bill.

If you have more than one holiday let, you may still be able to benefit from small business rate relief on main property as long as the rateable value of any other holiday lets or other business properties that you have is not more than £2,899 and the properties have a total rateable value not exceeding £20,000 (£28,000 in London). If you acquire a second business property, you will be able to keep the relief for 12 months.

If you are eligible for small business rate relief, you will need to claim it. It is not given automatically. You can do this by writing to your local authority. If you are not getting the relief, check your bills, as you may be able to claim retrospectively for previous years.

Future changes

From April 2023, you will only be eligible for business rates on a holiday let if it is let commercially for at least 70 days. As this is less stringent that the letting condition for tax purposes (which requires the property to be let for 105 days in the tax year), holiday lets that qualify as furnished holiday lettings will meet the business rates test.

When does a property rental business start?

A property rental business will have a start date and an end date, and it is important to know what those dates are.

When setting up a property rental business, there will be some preparatory work, and costs will be incurred in setting up the business. The start date will draw a line in the sand between activities that are preparatory to the letting and activities that are part of the property rental business.

Where a person has more than one property, they may well have more than one property business. All UK properties let properties owned by the same person form part of the same UK property rental business. However, overseas properties are kept separate, as are furnished holiday lettings and UK furnished holiday lets are kept separate from EU furnished holiday lets.

For example, if a person owns a buy-to-let property on their own, a UK furnished holiday let on their own and two residential lets with their spouse, they will have three property businesses:

a property rental business comprising the rental property which is solely owned;

a share in the property rental business comprising the two jointly owned rental properties; and

a UK furnished holiday lettings business.

The start date for each property will need to be established.

Once a business is up and running, any preparatory activities undertaken in relation to further let properties will be activities of the existing business, rather than preparatory activities.

Start date

The date that the rental business begins is a question of fact. Where the business is letting property, the business will start when the first letting commences.

On-going expenses

Once the property letting has commenced, relief for expenses incurred on or after the date of commencement is given in accordance with the usual rules. Expenses are deductible if they are revenue in nature and incurred wholly and exclusively for the purposes of the property rental business and a deduction is not otherwise prohibited. Relief for capital expenditure is given either in accordance with the cash basis capital expenditure rules where accounts are prepared under the cash basis, or through the capital allowances system.

Relief for expenses in getting further properties ready to let is given under these rules, rather than under the pre-trading rules.

Pre-commencement expenses

Expenses incurred before the first let may be deductible under the pre-trading rules. Under these rules, the expense is deductible if it is incurred in the seven years prior to the start of the property rental business, and the expense would have been deductible if it had been incurred once the property rental business had started. Where these conditions are met, the expense is treated as if it had been incurred on the day on which the property rental business started, and relief is given in calculating the rental profits for that period.

Similar rules apply to capital expenditure. Where capital allowances are available, any qualifying expenditure is treated as incurred on the start date and is taken into account in calculating capital allowances for the first period of account.

CGT on residential property gains – aware of the 60-day limit?

Statistics published by HMRC in August 2022 revealed that in the 2021/22 tax year, 129,000 taxpayers reported residential property disposal using HMRC’s online service, filing 137,000 returns in respect of 141,000 disposal and paying £1.7 billion in tax. However, an estimated 26,500 returns (20%) were filed late, suggesting some ignorance around the rules and the filing deadlines.

What do you need to know?

Need to report residential property gains

Where a chargeable gain is made on the sale of a residential property, the gain must be reported to HMRC within 60 days of completion of the sale.

A reportable gain will arise if you sell a residential property that has not been your only or main residence throughout the period you owned it (or the whole period bar the final nine months). This may be the case because the property has been let out or is a second home. Where the property is owned jointly, each co-owner must report their own share of the gain.

The gain must be reported to HMRC using the online service (see www.gov.uk/report-and-pay-your-capital-gains-tax/if-you-sold-a-property-in-the-uk-on-or-after-6-april-2020). You will need the property details to hand, including the address and post code, acquisition and completion dates, the cost of the property, the disposal proceeds, details of any enhancement expenditure and details of any reliefs or allowances that you wish to claim.

Need to pay associated tax

You will also need to pay the capital gains tax on the gain within the same 60-day window. This is the best estimate of the tax due at the time that the gain was made. You can make use of the annual exempt amount (unless it has been used on a residential property gain earlier in the tax year), and any losses already realised in the year, or brought forward.

Payments can be made by debit or corporate credit card, via online banking or by cheque,

You will need to finalise your capital gains tax position on your self-assessment return for the tax year in which the completion took place to take account of other disposals in the tax year. There may be further tax to pay if you have made chargeable gains on other assets. You may also be eligible for a refund if you realised a capital loss later in the tax year after the completion date of the property.

Useful Links

The advantages of a flexible profit sharing ratio

In a partnership, profits and losses are shared between the partners in accordance with the profit sharing ratio. This may be fixed, for example, three partners may agree to share profits in the ratio of 40:35:2; but it does not have to be. Instead, the partners can simply agree to share profits and losses in such proportions as is agreed between them.

A fixed profit sharing ratio has the advantage of certainty as each partner knows at the outset what their share of the profits will be. It also enables the partners to agree up front on an allocation with which they are happy, and which is transparent. However, this may not be the best option from a tax perspective. By contrast, a flexible profit sharing ratio whereby partners agree on the profit allocation each year according to their personal circumstances will allow them to minimise their combined tax bill. While this is unlikely to be acceptable where the partners only have a professional relationship with each other, where there is a personal relationship, for example, if the partners are married or in a civil partnership, a flexible profit sharing ratio can be advantageous from a tax perspective.

Example

Anne and Bill are married and in partnership. They agree to share profits and losses in such proportion as is agreed between them.

In 2021/22, Anne also has a job from which she earns £35,270. Bill’s only income is from the partnership.

The partnership makes a profit of £70,000. Taking account of their personal circumstances, they agree to share the profits in the ratio 2:5, so that Anne receives profits of £20,000 and Bill receives profits of £50,000.

Anne pays tax of £4,000 on her profits (£20,000 @ 20%).

Bill pays tax of £7,846 (20% (£50,000 - £12,570)).

Their combined tax bill is £11,846. If they had shared profits equally, the combined tax bill would have been £14,846 as £15,000 of the profits would have been taxed at 40% rather than 20%.

Anne retired from her job on 1 April 2022. In 2022/23 her only income is from the partnership. However, Bill undertakes a consultancy role from which he earns £40,000. The profits from the partnership are £60,000 for 2022/23. As their circumstances are different this year, it is better from a tax perspective to share profits in the ratio of 5:1, so that Anne receives profits of £50,000 on which she pays tax of £7,846 and Bill receives profits of £10,000 on which he pays tax of £2,000 – a combined tax bill of £9,846.

Had they continued to share profits in the ratio 2:5, Anne would have received profits of £17,143 on which she would have paid tax of £914.60 and Bill would have received profits of £42,857 on which he would have paid tax of £14,168.80, and their combined tax bill would have been £15,083.40. By adopting a flexible profit sharing ratio, they can reduce their combined tax bill by over £5,000.

Cycle to work tax-free

As the cost-of-living crisis deepens, many employees are looking to save money. One option is to cut the cost of the commute by cycling to work. There can be tax benefits for this too.

Exemption for employer-provided cycles

Employees can enjoy the use of employer-provided cycles and cyclists’ safety equipment without having to pay tax on the associated benefit as long as the following conditions are met:

1. There is no transfer of property in the cycle or equipment – it remains the property of the employer.

2. The employer uses the cycle and/or equipment mainly for qualifying journeys. These are journeys between home and work and business journeys.

3. The cycles and/or equipment are made available to the employees who want to make use of them. It is not necessary for each employee to have their own dedicated bike; the employer can operate a pool system where employees who want to borrow a bike can do so from a pool.

Salary sacrifice

A Cycle to Work scheme combines a salary sacrifice arrangement with hire agreement. There are a number of commercial providers offering such schemes, which are popular.

Under the scheme, the employee enters into a salary sacrifice scheme and gives up part of his or her salary in return for the provision of a cycle. The employee enters into a hire agreement, under which they hire the cycle from either the employer or a third party. The hire is paid for by the sacrificed salary.

As long as the above conditions are met, the provision of the cycle is exempt from tax. It is important to stress here that ownership of the cycle must not at this point pass to the employee. As employer provided cycles are protected from the operation of the alternative valuation rules, the exemption is not lost by using a salary sacrifice scheme. The arrangement allows the employee to save tax on the salary given up, and both the employer and employee to save Class 1 National Insurance.

Cycle to work schemes typically run for three years. At the end of the period, the employee has three options:

1. Extend the hire agreement.

2. Return the cycle and equipment.

3. Buy the cycle and equipment.

There are no tax consequences if the employee chooses option 1 or 2. If the employee decides to buy the bike, as long the amount paid is at least equal to the market value of the bike at the time of the transfer, there is no tax to pay. However, if the amount paid is less than the market value, the shortfall is a taxable benefit.

HMRC recognise that it can be difficult to establish the market value of a second-hand bike. Consequently, a simplified approach can be used under which no tax charge will arise as long as the employee pays at least the percentage of the original value for the age and original cost of the bike as shown in the table below.

Age of cycle Acceptable disposal value (% of original price)

Original price < £500 Original price £500 or more

1 year 18% 25%

18 months 16% 21%

2 years 13% 17%

3 years 8% 12%

4 years 3% 7%

5 years Negligible 2%

6 years & over Negligible Negligible

So, for example, if an employee pays at least £24 for a cycle costing £300 (8% of £300) at the end of a 3-year hire period there will be no tax to pay on the transfer.

Dividend Planning

The Chancellor’s recent mini-Budget and subsequent U - turns threw a number of spanners into the works as far as profit extraction strategies are concerned. Initial revisions to profit extraction strategies in the light of the mini-Budget announcements now need to be revised.

Rates

For 2022/23, the dividend allowance is £2,000. Where dividends are not sheltered by the dividend allowance or any unused personal allowance, they are taxed at the dividend ordinary rate of 8.25% where they fall in the basic rate band, at the dividend upper rate of 33.75% where they fall in the higher rate band and at 39.35% where they fall in the additional rate band.

The rates were increased from 6 April 2022 by 1.25% as part of a package of measures to raise funds for health and adult social care with the introduction of a dedicated Health and Social Care Levy. The Health and Social Care Levy has since been scrapped. It was announced at the time of the mini-Budget that the increased would be reversed from 6 April 2022. However, new Chancellor Jeremy Hunt subsequently announced that this will now not happen and dividend tax rates will remain at their 2022/23 levels. The basic rate of income tax was due to fall from 6 April 2023 from 20% to 19%. This cut has now been delayed and the basic rate will remain at 20%.

Extracting profits

If profits from a personal or family company are to be used for personal use, they need to be extracted from the company. There are various ways in which this can be done, but from a tax perspective, the goal is to do so in a way that minimises the total tax and National Insurance payable.

A popular tax efficient strategy is to take a small salary and to extract further profits as dividends. The optimal salary depends on whether the National Insurance employment allowance is available. If it is, as may be the case for a family company, the optimal salary for 2022/23 (assuming the personal allowance has not been used elsewhere) is equal to the personal allowance of £12,570. Personal companies where the sole employee is also a director do not benefit from the employment allowance. Where the employment allowance is not available, the optimal salary for 2022/23 is equal to the annual primary National Insurance threshold of £11,908.

The changes announced in the mini-Budget and the subsequent U-turns do not change the optimal salary for 2022/23.

Taking dividends

Once the optimal salary has been paid, it is more tax efficient to take any further yet)profits needed outside the company as dividends. Dividends are paid from post-tax profits and have already suffered corporation tax of 19%. The reinstatement of the proposed corporation tax reforms will mean that the funds from which dividends have paid may have suffered a rate of tax of more than 19% from 1 April 2023. This will be the case where profits exceed the lower profits limit, set at £50,000 for a stand-alone company.

For 2022/23, dividends should still be extracted (assuming sufficient retained profits are available) to use up the dividend allowance and any remaining personal allowance of the director and, in a family company scenario, any family members who are shareholders. Once the allowances have been used up, taking any further dividends will trigger a tax liability on those dividends. If the funds are not needed outside the company, it may be preferable not to pay a dividend to avoid the associated tax charge, perhaps delaying the payment of the dividend until it can be sheltered by a future year’s dividend or personal allowance.

Where further dividends are needed, the aim is to pay as little tax as possible. In a family company scenario, this may mean using the basic rate band of family members before paying dividends to the director where they would be taxable at a higher rate. As dividends must be paid in proportion to shareholdings, the tailoring of dividends to achieve this is only possible with an alphabet share structure whereby each family member has their own class of shares.

There is no substitute for crunching the numbers.

What expenses can you deduct?

To ensure that a business does not pay more income tax than it needs to, it is important that a deduction is claimed for all allowable expenses. The rules on what constitutes deductible expenditure can be confusing. They also depend on whether the accounts are prepared on the cash basis or the accruals basis. However, there are some basic rules which must be met.

Wholly and exclusively rule

The basic rule is that a deduction is allowed for expenses incurred wholly and exclusively for the purpose of the trade. The rule works by prohibiting expenses that are not wholly and exclusively incurred, stating:

‘In calculating the profits of a trade, no deduction is allowed for –

- expenses not incurred wholly and exclusively for the purposes of the trade…’

There is no requirement that the expense is necessarily incurred.

Consequently, you can deduct an expense if it is incurred wholly and exclusively for the purposes of your business and the deduction is not otherwise prohibited (as for certain entertaining expenses and depreciation).

No deduction for private expenditure

Only business expenses meeting the wholly and exclusively test can be deducted – a deduction for private expenditure is not permitted.

If you operate as a sole trader, it may be easy for the boundary between business expenses and personal expenses to become blurred. For example, you may pick up some items for your home at the same time as some cleaning products for the business and pay for them together. In this situation, it would be easy it inadvertently claim a deduction for the whole amount. If the business items can be separately identified, a deduction can be claimed for these.

To prevent errors, it is advisable to keep good records and keep business and personal expenditure private. Ideally, there should be a separate business bank account which is used for business expenses.

Mixed expenses

If an expense has a business and a private element and these cannot be separated, a deduction is not allowed. An example would be normal clothes worn for work. However, the cost of a uniform featuring the business logo can be deducted.

Capital expenditure

The rules governing the deductibility of capital expenditure can be tricky and depend on the basis used to prepare the accounts. If the tradition accruals basis is used, capital expenditure cannot be deducted in calculating profits. Instead, relief is given through the capital allowances system. Where the annual investment allowance is available, as long as the £1 million limit has not been used up, qualifying capital expenditure can be deducted in full (as a capital allowance) in the year in which it is incurred.

Different rules apply under the cash basis, and capital expenditure can be deducted unless it is of a type for which a deduction is specifically denied. The main items of capital expenditure which are not deductible under the cash basis are land and buildings and cars. Capital allowance may be available instead for cars (as long as simplified expenses have not been claimed).

Common deductible expenses

While the list of deductible expenses will vary from business to business depending on the nature of the business, the following is a list of common deductible expenses:

- cost of goods sold;

- packaging;

- distribution costs;

- staff costs (wages and salaries, pensions);

- premises costs (rent, insurance, light and heat, cleaning, repairs);

- office costs (stationery, phone costs, printing, postage);

- advertising;

- finance costs (but note an interest cap applies under the cash basis); and

- accountancy and legal costs.

Check the list to ensure deductible items have not been overlooked.

VAT bad debt relief

If you are a VAT-registered business you must charge VAT when you make taxable supplies. You must also pay over the difference between VAT you have charged and the VAT that you have suffered to HMRC (or, where a scheme such as the flat rate scheme is used, the amount due to HMRC under the scheme rules). Assuming your customers pay their bills, it is the customer who provides the funds for the output tax which must be passed on to HMRC and from which you can recover any input tax that you have incurred.

But what happens if the customer cannot or will not pay their bill?

If you are not paid for supplies of goods or services that you have made to a customer on which you have charged VAT, you may be able to claim relief from VAT on the bad debts that you have incurred. Conversely, if you do not pay bills on which you have reclaimed input VAT, you may need to repay that VAT.

Bad debts

You can claim relief for VAT on bad debts if the following conditions are met.

- You have already accounted for the VAT on the supplies and paid it to HMRC.

- You have written off the bad debt in your day-to-day VAT account and transferred it to a separate bad debt account.

- The value of the supply is not more than the customary selling price.

- The debt has not been paid, sold or factored under a valid legal assignment.

- The debt has remained unpaid for a period of 6 months from the later of the time that the payment was due and payable and the date that the supply was made.

It should be noted that if you use the cash accounting scheme or a retail scheme that allows you to adjust your daily takings for opening and closing debtors, a claim for bad debt relief is unnecessary as VAT is only paid on amounts that you have actually received from your customers.

You must wait at least 6 months from the later of the date on which the payment was due and payable and the date of the supply before making a claim. The claim must be made within 4 years and 6 months from that date. You can claim the relief in your VAT return, but the claim cannot be made in a return for a VAT accounting earlier than the one in which you become entitled to the relief.

The need to wait 6 months before making the claim means that you will have to pay the VAT over to HMRC in the first instance (and meet the cost of this) before claiming it back.

You must also notify your defaulting customer that you have made a claim for bad debt relief.

Repaying input tax

If you do not pay a supplier and you have reclaimed VAT on that supply, you must repay the input tax if the debt remains unpaid 6 months from the later of the date of the supply or date on which the payment was due. If you are given time to pay (for example, payment terms are 30 days), the clock starts from the date payment is due rather than the invoice date.

To make the repayment, you should make a negative entry in your VAT return and account for the repayment in the return for the period in which the repayment became due.

Tax efficient ways of selling your company

If economic advisers are to be believed then we are heading into a recession lasting at least a year and every recession brings with it business casualties. Some companies are pre-empting and selling up now. When selling a private limited company you have two possible routes: a sale of the company’s shares, and/or a sale of the company’s assets.

Under a share sale, the buyer acquires all the company’s shares and the company continues with the buyer as the new owner. With an asset sale, the buyer will acquire all or certain assets of the company, and they may also assume certain liabilities associated with those assets. The buyer takes over ownership of the assets, leaving the company as a ‘shell’ which is then closed down after the sale. It is normally more beneficial to sell company shares rather than go down the asset sale route because the latter brings with it the problem of extracting the sale proceeds from the company which could lead to a double tax charge.

Usually, the sale proceeds are in cash but that need not necessarily be the case - sometimes they may be in the form of loan notes (Qualifying Corporate Bonds) or a mixture of both.

Cash or loan notes?

Cash

Selling shares in a company brings with it the advantage of claiming Business Asset Disposal Relief (BADR) which is a major attraction for the seller. However, there are conditions which, if not met, result in a loss of relief.

BADR is not a ‘relief’, but a special CGT rate applying to gains realised on the disposal of certain qualifying business assets. A claim to BADR charges CGT at 10% and, as such, is particularly beneficial to higher and additional rate taxpayers who otherwise would be charged 20%.

The fundamental requirement for BADR is that the seller is required to work for the company (as a director or employee). The disposal must be 'qualifying' which includes a material disposal of business assets. Business assets for this purpose include all or part of a trade, qualifying share disposals by directors (or, if relevant, employees), or assets of the trade.

The claim is subject to an overriding lifetime allowance claimable by any individual -- currently £1m. BADR must be claimed on or before the first anniversary of the 31 January following the tax year in which the disposal takes place.

Loan Notes

If the shares are sold at a gain, this is usually taxed in the year in which the sale contract is agreed but the gain can be reduced or at least deferred by paying the seller wholly or partly in fixed-interest loan notes (qualifying corporate bonds - QCB) spread over possibly several years. Essentially these loan notes are IOUs, usually coming with restrictions on when they can be encashed. Under special rules when shares are sold in exchange for QCBs, a capital gain is calculated as if it is chargeable when the QCB is redeemed, disposed of or ceases to qualify as a QCB.

The main disadvantage is that BADR cannot be claimed by taking these notes. However, this may be more tax effective than first thought as spreading the gain can lower the overall tax burden compared with taking all the sale proceeds as cash (even if BADR can be claimed). Spreading over several years will enable the use of the annual allowance (if not otherwise used each year) and lower tax rates may mean that the tax bill is lower overall than taking all the money in one go. It should be noted that this practice may not reduce the tax bill as much as it would before the Autumn Statement. In that statement, the Chancellor announced that the annual exempt amount is to be cut from £12,300 to £6,000 from 6 April 2023 and then halved again to £3,000 from 6 April 2024.

However, to take advantage of this tax planning, the company needs to be the seller's company when the QCBs are redeemed. A way of achieving this is for the seller to negotiate to remain with the company as a director or employee and importantly, maintain a 5% shareholding. Further, if the seller was married they could transfer some of the loan notes to the spouse before redeeming them which would further reduce the tax bill.

Using a period of grace election for furnished holiday lettings

January 2024

The cost of living crisis has impacted on people’s ability to take holidays and short breaks. If you are a landlord letting a furnished holiday let (FHL), you may find that the downturn in bookings means that you are unable to pass the occupancy tests for your let to qualify as an FHL for tax purposes.

For a let property to count as an FHL, the property must be in the UK or the EEA and must contain sufficient furniture for normal occupation. It must also pass three occupancy tests.

Condition 1 – the pattern of occupation condition

For the property to be an FHL, the total of all lets that exceed 31 days must not be more than 155 days in the year.

Condition 2 – the availability condition

The property must be available for letting for at least 210 days in the tax year.

Condition 3 – the letting condition

The property must be actually let for at least 105 days in the tax year.

If the letting condition has not been met in a particular year, you may be able to use a period of grace election to ensure a property that has previously qualified as an FHL continues to do so.

Period of grace election

A period of grace election can be used where the landlord genuinely intended to meet the letting condition but was unable to. The impact of the cost of living crisis is an example of where this may be the case, and offers landlords a potential lifeline.

To make a period of grace election, the pattern of occupation and availability conditions must still be met. Also, the letting condition must have been met in the year before the first year for which the landlord wishes to make a period of grace election. If the letting condition is not met again in the following year, a second period of grace election can be made. However, if the test is not met in year 4 after two period of grace elections, the property will no longer qualify as an FHL. A period of grace election can be made either on the Self Assessment tax return or separately (either with or without an averaging election).

For example, if the property met the letting condition in 2022/23, a period of grace election can be made for 2023/24 and 2024/25 if the letting condition is not met in those years, as long as the other two occupancy conditions are met. However, the letting condition must be met again in 2025/26 for the property to qualify as an FHL for that year.

A period of grace election for 2023/24 must be made by 31 January 2026.

Multiple FHLs and averaging

In the event that a landlord has more than one FHL, and the letting condition is met in some but not all of the properties, an averaging election could be made instead. Where this is made, the test is treated as met if on average the holiday lets are let for 105 days in the tax year. For example, a landlord with three holiday lets would need the properties to be let for a minimum of 315 days in total for an averaging election to be used to meet the letting condition across all three properties.

Mileage allowance payments

To save work, employers can pay employees a mileage allowance if they use their own car for business journeys. The Government have recently cleared up confusion as to what can be paid tax-free, confirming the maximum tax-free amount.

Mileage allowance payments

The approved mileage allowance payments system is a simplified system that allows employers to pay tax-free mileage allowance payments to employees who use their cars for business travel. Under the system, payments can be made tax-free up to the ‘approved amount’.

A similar, but not identical, system applies for National Insurance purposes.

The approved amount

The approved amount for tax is calculated for the tax year as a whole and is simply the reimbursed business mileage for the tax year multiplied by the tax-free mileage rates for the type of vehicle used by the employee. Rates are set for cars and vans, motor cycles and cycles and are as shown in the table below. They have been unchanged since 2011/12.

Example

Mo uses his own car for business and drives 12,350 miles in the tax year. The approved amount is £5,087.50 (10,000 miles @ 45p per mile + 2,350 miles @ 25p per mile).

Any payments made in excess of the approved amount are taxable and must be reported to HMRC on the employee’s P11D. If, on the other hand, the employer does not pay a mileage allowance or pays less than the approved amount, the employee can claim a deduction for the difference between the approved amount and the amount actually paid, if any.

Confusion

Earlier in the year, a petition went before Parliament calling for an increase in the advisory rate from 45 pence per mile to 60 pence per mile to reflect the increases in fuel prices since 2011. Parliament rejected the petition stating that the rates remained adequate as they covered all running costs and the fuel element was only a small part. However, in their response, they pointed out that employers could pay higher amounts tax-free where this represented the amount of actual expenditure and could be substantiated:

‘The AMAP rate is advisory. Organisations can choose to reimburse more than the advisory rate, without the recipient being liable for a tax charge, provided that evidence of expenditure is provided.’

The Government subsequently backtracked on this, stating in a written Parliamentary statement that:

‘The response [to the petition] stated that actual expenditure in relation to business mileage could be reimbursed free of Income Tax and National Insurance contributions. This is in fact only possible for volunteer drivers. Where an employer reimburses more than the AMAP rate, Income Tax and National Insurance are due on the difference. The AMAP rate exists to reduce the administrative burden on employers.’

Maximum tax-free amount

The maximum amount that can therefore be paid tax-free to employees using their own car for work is the approved amount, regardless of the car that they drive or the actual costs incurred. However, if the employer wishes to pay more, car sharing could be encouraged and the employer could also pay passenger payments (of 5 pence per mile) for each colleague that the driver gives a lift to (providing the journey is also a business journey for them).

For company car drivers, the maximum tax-free amount that can be paid is governed by the prevailing advisory fuel rates published by HMRC.

Where there’s a will there could be tax savings

How will planning can help to reduce inheritance tax liabilities.

In April 2023, the National Will Register reported that 42% of adults in the UK had not made any provisions for their estate distribution in the event of death.

This leads to individuals having no control over how the estate is eventually distributed and increases the likelihood of a high inheritance tax (IHT) charge suffered by the beneficiaries.

To ensure that inheritance left behind is maximised with a minimum tax charge, a number of planning measures can be considered when a will is drawn up, including those outlined below.

Exempt beneficiaries

The primary advantage of a will is that the deceased’s estate is distributed according to the wishes of the individual. A popular measure is to leave the entire estate to the spouse or civil partner, as this could lead to the entire inheritance being exempt.

Charity organisations are generally also exempt beneficiaries. Not only is the asset donated to a charity treated as an exempt transfer on death, but if the transfer is more than equal to 10% of the estate’s baseline amount, the IHT charge goes down to 36% (from 40%).

The baseline amount is the estate’s value after adjusting for any exemptions and the nil-rate band (NRB) but before the charitable donation and residence nil-rate band (RNRB) are dealt with.

Exempt transfers

If the individual has children who are minors, they can set up a bare trust in their will. This results in the assets transferred to the trust being managed by the trustees until such time as the beneficiary comes of legal age, whereupon the rights to all the capital and any income from the asset pass to the beneficiary.

Not only is this an effective way of protecting the interests of the dependents, but transfers to a trust result in the asset being excluded from the death estate calculation, leading to a reduced IHT charge.

Life policies

Another option is setting up a life insurance policy in trust. This will exclude the policy payout from the death estate calculation, but the payout can still be made to the beneficiaries specified in the instructions to the trustees.

Any risk of lifetime IHT on the premiums paid can be reduced or avoided by using the annual exemption of £3,000, or by ensuring that the premiums satisfy the conditions to fall within the ‘normal expenditure out of income’ exemption (see IHTA 1984, 21(2)).

Reduction in tax charge

In the context of families, an effective double IHT charge can be avoided if the individual ‘skips’ a generation when specifying the beneficiaries in the will. Assets left to the children will lead to an initial tax charge that will repeat when these assets are then transferred to the next generation.

The family as a whole can potentially save tax if the initial inheritance is bequeathed directly to the grandchildren, leading to a single tax charge on the assets transferred.

Naming direct descendants (children or grandchildren) as the beneficiaries of the residence possessed by the individual will lead to the deduction of £175,000 RNRB in the taxable estate calculation. This will lead to a direct tax reduction of £70,000 (i.e., £175,000 x 40%) and may be doubled if the unused RNRB of a deceased spouse or civil partner is available.

Investing in unquoted or quoted shares and securities of trading companies controlled by the individual can lead business property relief, provided assets have been owned for at least two years. Depending upon the type of investment, the relief can reduce the value of the investments by 50% or 100%, thereby possibly eliminating or reducing the tax charge.

As long as the individual is of sound mind and not under any undue pressure, the document written, signed, dated and witnessed by two independent witnesses will be legally valid.

Practical tip

A will can easily be replaced by a new one; or a codicil could be drawn up to amend the current one.

Covid-19 helpsheets